-

EUR/USD picks up bids to consolidate recent losses, forms bullish chart pattern.

-

Convergence of 50-HMA, 100-HMA and fortnight-long resistance line appears a tough nut to crack for Euro buyers.

-

Sellers can aim for late March swing lows on 1.0760 breakdown.

-

ECB’s Lagarde, Fed Minutes eyed for clear directions.

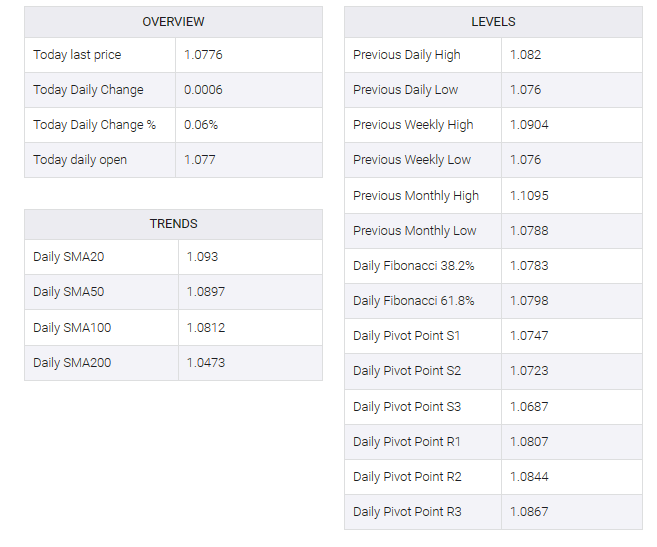

EUR/USD moved to a dicey floor with modest gains near 1.0775 as Europe awaited key catalysts early Wednesday. In doing so, the euro pair formed a bullish chart pattern called a “double bottom” based on a speech by European Central Bank (ECB) President Christine Lagarde and the minutes of the recent Federal Open Market Committee (FOMC) monetary policy meeting.

Also Read: EUR/USD dribbles below 1.0800 amid US debt ceiling talks, focus on ECB’s Lagarde, Fed Minutes

Not only the “double bottom” formation but also the recent improvement of the RSI (14) line from the oversold zone and the bullish MACD signals also underpin the hope for further recovery of the EUR/USD pair.

However, the 100-hour moving average (HMA) joins the 50-HMA and a down-sloping trend line that forms 1.0800 as key upside barriers for euro buyers to regain control.

After that, a quick run to the 200-HMA and mid-May lows around 1.0835 and 1.0845 respectively cannot be ruled out.

In contrast, the EUR/USD pullback remains elusive unless the quote is out of the “double bottom” around 1.0760.

If the Euro bear manages to conquer the 1.0760 key support and defy a bullish chart formation, the pair risks plunging to the late March lows of 1.0715.

EUR/USD: Hourly chart

Trend: Limited recovery expected