-

AUD/USD takes offers to refresh monthly low, extends previous day’s fall.

-

Clear downside break of 2.5-month-old ascending trend line, bearish MACD signals favor sellers.

-

Below 50.0 RSI levels, nearness to key supports suggest limited downside room for Aussie bears to cheer.

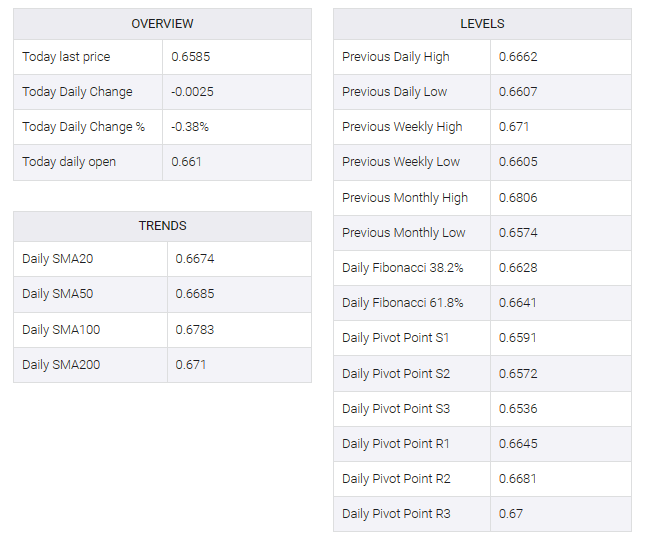

AUD/USD drops to a fresh low since late April as bears cheer technical breakdown, as well as trace New Zealand Dollar (NZD), amid early Wednesday morning in Europe. In doing so, the Aussie pair prints a two-day downbeat as it flashes 0.6585 level by the press time.

That said, a daily close below the 10-week-long ascending support line and bearish MACD signals keep Aussie pair sellers optimistic. However, the lows marked in April and March, near 0.6575 and 0.6565 respectively, could tempt intraday bears.

It is worth noting, however, that the October 2022 peak joins the 61.8% Fibonacci retracement level of the pair’s run-up from last October to February to highlight the 0.6545 mark as key short-term support.

In a case where the Aussie pair breaks the same, the possibility of witnessing a decline towards the November lows near 0.6270 cannot be ruled out.

Conversely, the support-turn-resistance line, close to press time 0.6610, limits the Aussie pair’s immediate upside.

After that, a conversion of the 21-DMA and 50% Fibonacci retracement, last near 0.6670, could challenge the AUD/USD bulls.

Above all, the 100-DMA and 38.2% Fibonacci retracement surrounding 0.6780 holds the key to the buyer’s dominance.

AUD/USD: Daily chart

Trend: Limited downside expected