-

USD/CHF gains some positive traction on Thursday, albeit lacks follow-through.

-

The USD trims a part of its intraday gains and acts as a headwind for the major.

-

The Fed’s hawkish outlook favours the USD and should lend support to the pair.

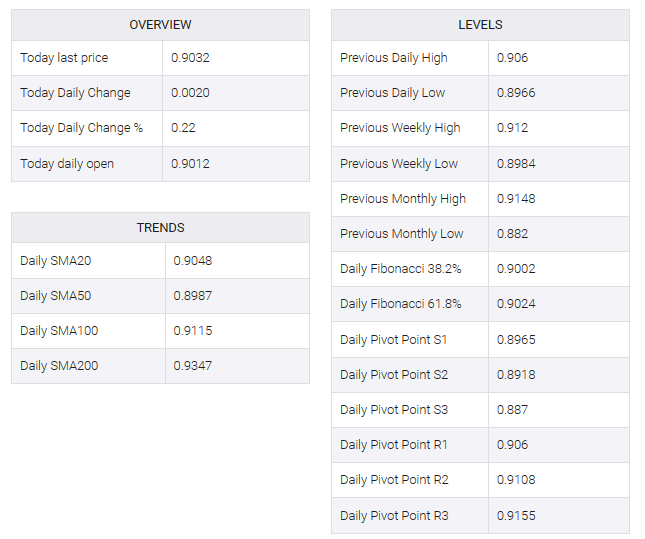

The USD/CHF pair builds on the previous day’s late rebound from over a three-week low and gains some positive traction on Thursday, albeit struggles to capitalize on the move beyond mid-0.9000s. Spot prices retreat a few pips from the daily low and trade around the 0.9030 region, up over 0.20% during the first half of the European session.

The US dollar (USD) pared a chunk of strong intraday gains and, for now, appears to have stalled its recovery move from the one-month low touched on Wednesday, which, in turn, is acting as a headwind for USD/CHF. Additionally, a softer risk tone benefits the safe-haven Swiss franc (CHF) and further contributes to capping upside for the majors. Market sentiment remains fragile due to global economic slowdown concerns, particularly in China. Those fears were heightened by disappointing Chinese macro data released earlier today, which whetted investor appetite for riskier assets and largely overshadowed moves by the People’s Bank of China (PBOC) to cut medium-term lending rates.

The USD’s downside, meanwhile, appears to be cushioned on the back of the Federal Reserve’s (Fed) more dovish outlook, indicating that borrowing costs may still rise by up to 50 bps by the end of this year. In fact, the so-called “dot plot” indicates that officials now see rates rising to 5.6% this year, up from March’s projection of 5.1%. Moreover, the Fed now sees somewhat stronger economic growth and forecasts the economy to expand 1% this year – up from 0.4% growth estimated in May – before rising to 1.1% in 2024 and 1.8% in 2025. This triggered a fresh leg up in US Treasury bond yields, which could lend some support to the greenback and the USD/CHF pair, at least for now.

Market participants are now looking to the US economic docket, which includes the release of monthly retail sales, weekly initial jobless claims, Empire State Manufacturing Index, Philly Fed Manufacturing Index and Industrial Production. This, along with US bond yields, will influence USD price dynamics and provide some meaningful impetus to the USD/CHF pair later in the first North American session. Traders will take cues from broader risk sentiment to seize short-term opportunities. The aforementioned fundamental backdrop, meanwhile, now seems to be leaning in favor of bullish traders.