-

USD/CHF slides below key technical support levels: 50 and 20-day EMAs.

-

Bears target a May 22 swing low of 0.8940, with eyes on the psychological 0.8900 level.

-

Oscillators RSI and RoC signal continued downward momentum.

USD/CHF nosedives ahead of the Federal Reserve’s (Fed) decision after falling below technical support levels, trading below the 0.9000 handle after reaching a daily high of 0.9060. At the time of writing, the USD/CHF is trading at 0.8969, down 0.90%.

USD/CHF Price Analysis: Technical outlook

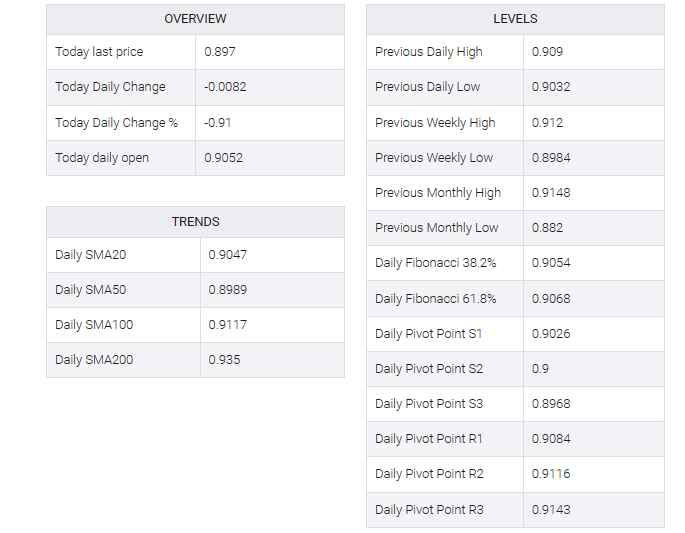

USD/CHF resumed its bearish bias after breaking below the 50 and 20-day exponential moving averages (EMAs), at 0.9038 and 0.9033, respectively. After that, USD/CHF extended its losses, breaking above the 0.9000 mark and dropping to a fresh three-week low of 0.8965 before setting a target of 0.8970. For a bearish continuation, USD/CHF needs to clear the May 22 swing low of 0.8940, which would reveal the 0.8900 psychological price level as the next support.

Conversely, USD/CHF buyers must re-claim the 0.9000 figure if they want to see prices higher. This will open the door towards 0.9033/38, the confluence of the 20 and 50-day EMA, before testing the intersection of the 100-day EMA and the April 10 daily high of 0.9114/20.

Hence, the USD/CHF trend is down, supported by the oscillator. The relative strength index (RSI) and three-day rate of change (RoC) remain in bearish territory.