-

AUD/USD retreats from the highest level since late February, pokes eight-day-old ascending support line.

-

Overbought RSI, downbeat sentiment suggests further downside of the risk-barometer pair.

-

Aussie bears also need softer US Retail Sales, mid-tier activity data for conviction.

AUD/USD fades a five-day-old bullish momentum at the highest levels in nearly 16 weeks as markets await more clues to confirm the Fed’s hawkish bias for the July rate hike.

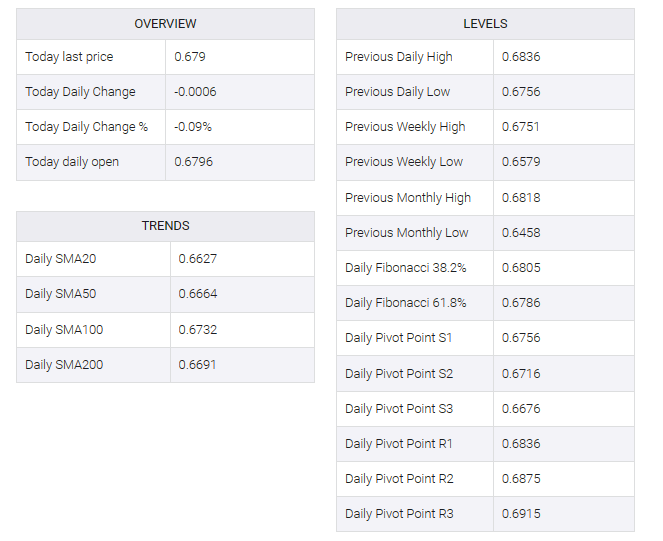

In doing so, the Aussie pair battled upbeat employment and inflation data from home, as well as downbeat China figures earlier on Thursday. That said, the Aussie pair remains indecisive near 0.6795 as it recently formed a short-term support line.

Also Read: AUD/USD daily lower on Australian jobs report, ahead of later Chinese macro data

Technically, an upward-sloping trend line from June 05, last near 0.6785, limits immediate AUD/USD declines even as the overbought RSI (14) line indicates a pullback move for the pair.

However, a clear negative break of the said support line would leave the AUD/USD pair vulnerable to a decline towards the mid-May swing high around 0.6710 before targeting the 200-SMA level around 0.6655.

On the other hand, US data should ease the AUD/USD recovery and ease the odds of a Fed July rate hike to target again for the key resistance line extended from mid-April near 0.6835.

After that, a run towards the December 2022 peak near 0.6895 and then the 0.6900 round figure cannot be ruled out.

AUD/USD: Four-hour chart

Trend: Limited downside expected