-

USD/CHF takes offers to reverse the week-start gains, mildly offered of late.

-

Convergence of 100 and 200-EMA restricts immediate upside within three-week-old bullish channel.

-

Ascending support line from June 26 restricts immediate downside.

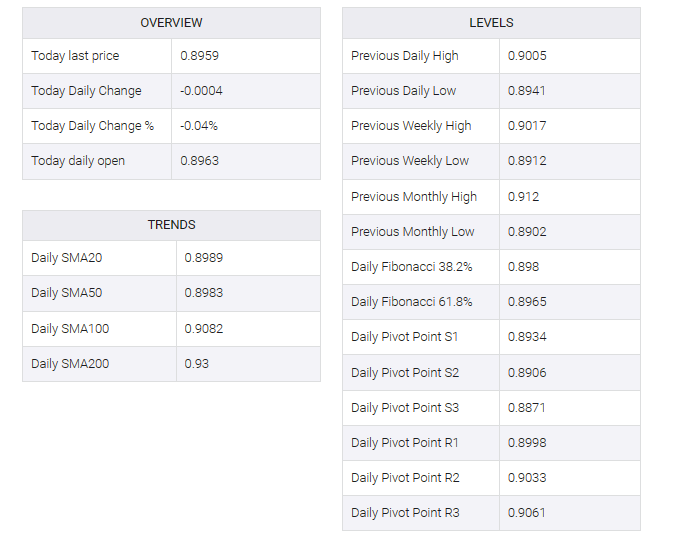

USD/CHF held lower ground near 0.8960 as it reversed an early week rebound amid a sluggish Asian session on Tuesday. By doing so, the Swiss Franc (CHF) pair is under pressure below a convergence of the 100 and 200 Exponential Moving Averages (EMA).

Bearish MACD signals and stable RSI (14) lines are adding strength to the bearish bias.

However, the one-week-old rising support line near 0.8945 by press time, limits immediate losses for the USD/CHF pair.

Next, the bottom line of the aforementioned three-week-old rising trend channel, last near 0.8920, holds the key to the downside for the pair.

In a case where the Swiss Franc pair breaks the 0.8920 support and defies bullish chart formation, the previous monthly low of 0.8910 could act as an additional filter to the south before the USD/CHF bear is directed to the yearly lows marked in May. 0.8820.

Conversely, a clear upside break of the 100 and 200 EMA near 0.8970, could quickly push the USD/CHF price towards the 0.9000 psychological magnet. However, the top line of the aforementioned bullish channel, near 0.9020, as we write, could prompt buyers for the pair later.

Overall, USD/CHF is likely to improve gradually but a short-term pullback cannot be ruled out.

USD/CHF: Hourly chart

Trend: Limited downside expected