-

USD/CAD remains sidelined between 21-DMA and 10-DMA, fades bounce off intraday low recently.

-

Multiple Doji candlestick portrays the Loonie trader’s indecision near the lowest levels since September 2022.

-

Bullish MACD signals, higher low formation suggest buyers flexing muscles.

-

Sellers need validation from 1.3165; buyers may wait for 1.3340 breakout for conviction.

USD/CAD stays defensive for the fourth consecutive day around 1.3250 heading into Tuesday’s European session.

The latest inactivity in the Looney pair may be linked to the US Independence Day holiday and a cautious mood ahead of Canadian catalysts. That said, the Bank of Canada’s (BoC) Business Outlook Survey and June’s S&P Global Manufacturing PMI readings look important to watch for clear direction.

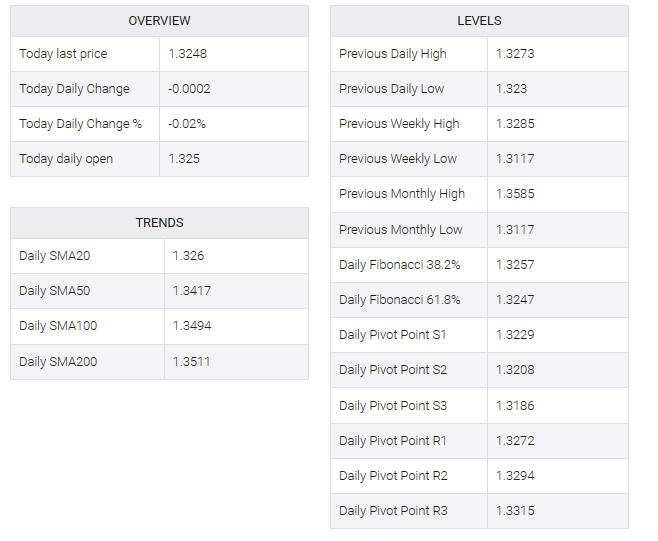

That said, multiple doji candlesticks depict the inactivity of the loonie pair between the 21-DMA and 10-DMA, near 1.3260 and 1.3210 respectively.

However, recent higher lows and bullish MACD signals suggest recovery of the USD/CAD pair by crossing the 1.3260 barrier consisting of 21-DMA.

Nevertheless, the previous support line from November 15, 2022, last around 1.3340, becomes important to convince the loonie pair buyers.

On the upside, a daily close below the 10-DMA support of 1.3210 would require validation from the 1.3200 round figure and the latest multi-month low near 1.3165 to renew the bearish bias towards the loonie pair, identified last week.

Next, the 1.3000 psychological magnet and the September 2022 low around 1.2965 will be in the spotlight.

USD/CAD: Daily chart

Trend: Builds upside momentum