-

NZD/USD trades with a positive bias for the third successive day, though lacks follow-through.

-

A big divergence in the Fed-RBNZ policy outlook continues to act as a headwind for the major.

-

Traders might also refrain from placing fresh bets ahead of this week’s key releases from the US.

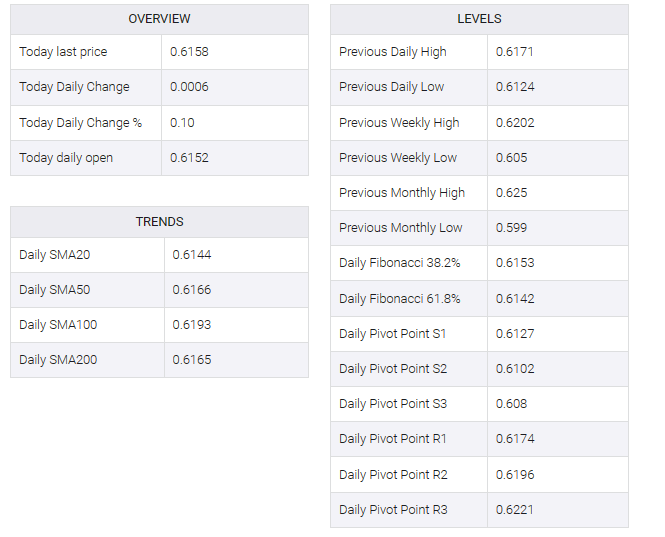

The NZD/USD pair attracts some buyers for the third successive day on Tuesday and holds steady above mid-0.6100s through the Asian session. Spot prices, however, remain well within the previous day’s broader trading range, warranting some caution before positioning for an extension of the recent bounce from a three-week low touched last Thursday.

The US Dollar (USD) is struggling to gain any meaningful traction given the uncertainty over the Federal Reserve’s future rate-hike path and a key factor for the NZD/USD pair has become debt support. It is worth recalling that the US central bank indicated in June that borrowing costs should still rise by 50 bps by the end of this year, and Fed Chair Jerome Powell reinforced this view last week. That said, incoming US macro data is fueling speculation that the central bank will soften its hawkish stance sooner rather than later, putting US dollar bulls on the defensive.

Indeed, the US Bureau of Economic Analysis reported on Friday that the annual PCE price index fell to 3.8% in May from 4.3% previously, and the core gauge fell to 4.6% from 4.7% in April. Adding to that, the ISM manufacturing PMI remained in contraction territory for the eighth consecutive month in June and fell to the lowest level since May 2020. However, markets are still pricing in a 25 bps lift-off at the July FOMC meeting. This marked a major deviation from the Reserve Bank of New Zealand’s (RBNZ) dovish shift, indicating that it was done with the most aggressive hiking cycle since 1999.

The aforementioned fundamental backdrop makes it prudent to wait for strong follow-through selling before placing fresh bullish bets around the NZD/USD pair ahead of this week’s key release. Minutes from the June FOMC meeting are due on Wednesday and will be scrutinized for signals about the Fed’s future rate-hike path. This will be followed by US monthly jobs data – known as Nonfarm Payrolls (NFP) on Friday, which will impact the USD. Meanwhile, traders may prefer to wait on the sidelines amid relatively thin trading on the back of the Independence Day holiday in the US.