-

AUD/USD extends recovery from weekly low during the first positive day in three.

-

Key DMAs challenge Aussie buyers amid bearish MACD signals.

-

US NFP, 0.6560 can challenge sellers even if the immediate support breaks.

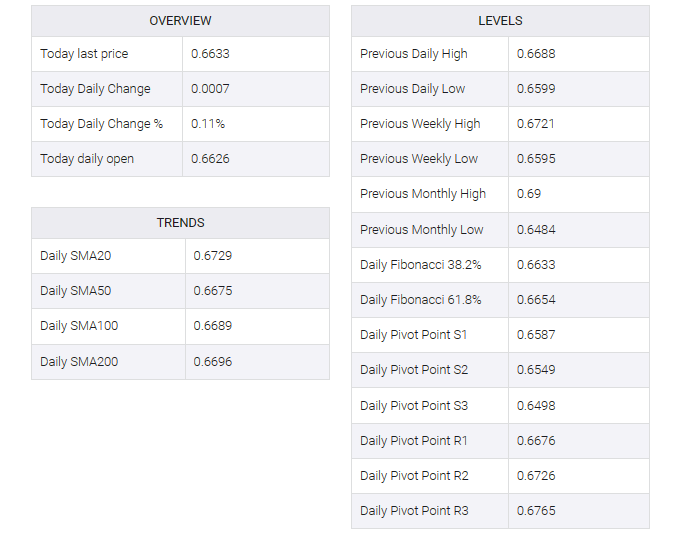

AUD/USD clings to mild gains near intraday highs of 0.6636 as it consolidates weekly losses ahead of the US employment report. In doing so, the Aussie pair printed its first daily gain while extending the early Asian session’s rebound from the four-month-old support line that headlined Friday’s European session.

The RSI (14) line below 50.00 joins the aforementioned support line for the latest rebound, challenging the 100-DMA and 200-DMA AUD/USD bulls between bearish MACD signals at 0.6685 and 0.6700 respectively.

Hence, the AUD/USD pair is likely to drop, adding to the importance of today’s US Nonfarm Payrolls (NFP) as well as China headlines.

Also Read: AUD/USD clings to modest gains near 0.6630, upside appears limited ahead of US NFP

That said, a clear upside break of 0.6700 would target a 38.2% Fibonacci retracement of the February-May downside, near 0.6725. However, multiple tops identified near the 50% and 61.8% Fibonacci retracements, around 0.6810 and 0.6890 respectively, may limit further advances for the Aussie pair.

On the upside, a daily closing below the rising trend line from March, last around 0.6600, is not an open invitation for AUD/USD bears as early June could test the downside before highlighting a swing around 0.6560 to witness a new annual low. Potentially, currently around 0.6460.

Overall, AUD/USD is likely to remain sideways but bears have more strength than bulls, unless US NFP disappoints by a wide margin.

AUD/USD: Daily chart

Trend: Limited recovery expected