-

USD/CHF loses momentum around 0.8730, down 0.24% in the early Asian trading hours.

-

The renewed trade war tensions between the US-China might exert pressure on USD/CHF.

-

Investors await the US ADP employment, the Swiss CPI y/y.

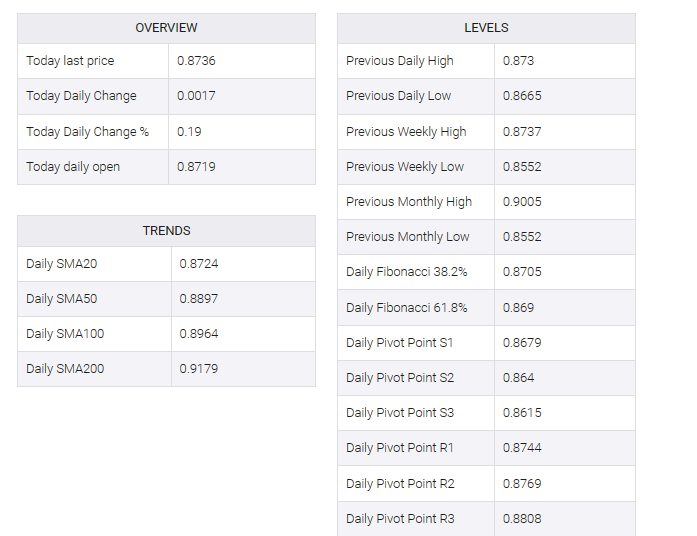

The USD/CHF pair snapped a four-day winning streak near 0.8730 in the early Asian session on Wednesday. Market participants await the US ADP employment report in the American session for some indication of Friday’s nonfarm payrolls. Meanwhile, the US Dollar Index (DXY), a measure of the greenback’s value against six other major currencies, lost momentum to 101.95 after retreating from the 102.45 mark.

On Tuesday, the US Bureau of Labor Statistics (BLS) reported that JOLTS job openings in June came in at 9.58 million. This reading followed May’s 9.82 million open and was below the market consensus of 9.62 million. Meanwhile, the ISM manufacturing PMI rose to 46.4 from 46 in July, but was below expectations of 46.8.

Renewed trade war tensions between the US and China could weaken the US dollar and act as a headwind for the USD/CHF pair. Chinese authorities on Monday announced restrictions on the export of certain drones and drone-related equipment to the United States, citing “national security and interests.” According to the commerce ministry, the ban will come into effect from September 1. It is worth noting that the US is China’s largest export market for drones.

In addition, US President Joe Biden plans to sign an executive order in mid-August to curb US technology investment in China. Investors will keep an eye on developments around the US-China relationship. Tensions between the world’s two largest economies could benefit the traditional safe-haven Swiss franc (CHF) and be bullish for USD/CHF.

Regarding the data, the Center for European Economic Research’s Swiss ZEW survey expectations data reported a figure of -32.6 versus -30.8 earlier and worse than the expected 31.1. Swiss retail sales for the year in June came in at 1.8% versus a 0.9% decline in May.

Going forward, the Swiss SECO Consumer Climate, Manufacturing PMI, and Consumer Price Index (CPI) can provide clues about the y/y movement of the Swiss Franc. Market players will be eyeing the release of the US ADP employment report after the previous day’s US ISM Service PMI and nonfarm payrolls. Traders will take cues from the data and find opportunities around the USD/CHF pair.