-

USD/CHF remains confined in a narrow range with mild gains above the 0.8800 area.

-

The pair holds above the 50- and 100-hour EMAs; RSI and MACD hold above the bullish territory.

-

The immediate resistance level will emerge at 0.8830; 0.8770 acts as an initial support level.

The USD/CHF pair traded flat with slight gains above 0.8800 heading into Thursday’s early European session. The pair has been trading in consolidation phase since July 27.

That said, upbeat US data and the prospect of a tighter cycle from the Federal Reserve (Fed) are key drivers of US Dollar (USD) strength and USD/CHF higher. Federal Open Market Committee (FOMC) minutes emphasized that inflation remains unacceptably high while Fed officials opened the door to additional tightening of monetary policy to bring inflation to the long-term target.

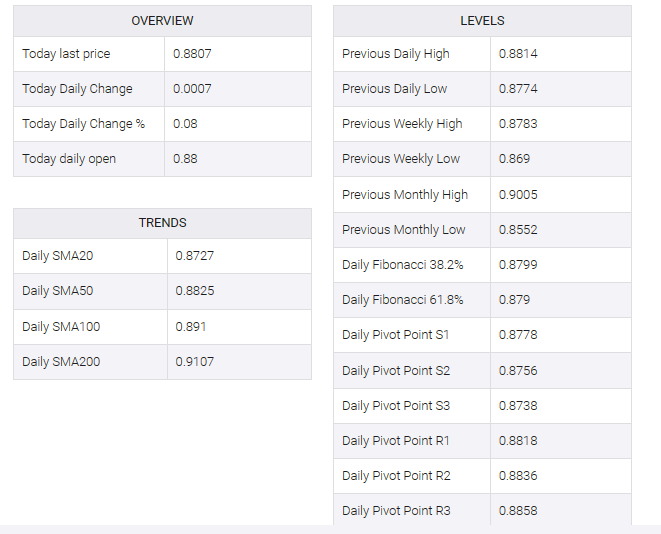

From a technical perspective, USD/CHF holds above the 50- and 100-hour exponential moving averages (EMAs) with an upward slope, meaning the path of least resistance for the pair is up. Additionally, the Relative Strength Index (RSI) stands above 50, while the Moving Average Convergence/Divergence (MACD) is above bullish territory, supporting buyers for now.

Immediate resistance for USD/CHF will be at 0.8830 (August 14 high). Additional upside filters in at 0.8875 (July 7 high) on the way to a psychological round mark at 0.8900. A break above the latter would see the next hurdle at 0.8920 (July 10 high).

Looking at the downside, 0.8770 acts as an initial support level for the pair, portraying the 50-hour EMA and a low of August 15. Further south, the next stop of the USD/CHF pair is located at 0.8755 (the 100-hour EMA, a low of August 11). Any intraday pullback below the latter would expose the next critical contention level at 0.8700. The mentioned level represents a low of August 4 and a psychological round figure. The next downside stop emerged at 0.8665 (low of July 31).