-

USD/CHF trades with mild gains around 0.8790, tallying a third consecutive day of gains.

-

The USD trades flat as investors await clues for the next Fed decisions in the FOMC minutes.

-

Housing data from the US came in strong.

The USD/CHF pair traded flat on Wednesday with slight gains near the 0.8790 area. On the USD side, stronger building permits and housing since July failed to react to the greenback as markets focused on the Federal Open Market Committee (FOMC) minutes from the July meeting, which will be released later in the session.

As the US economy continues to strengthen and inflation declines, investors will want to see the FOMC member’s stance on the following decisions. Jerome Powell said the decision will depend on incoming data as recent data indicate the Federal Reserve is likely to hike further this cycle. In line with that, the probability of a 25 basis point hike at the next November meeting has risen to around 40%, according to the World Interest Rate Possibilities (WIRP) tool.

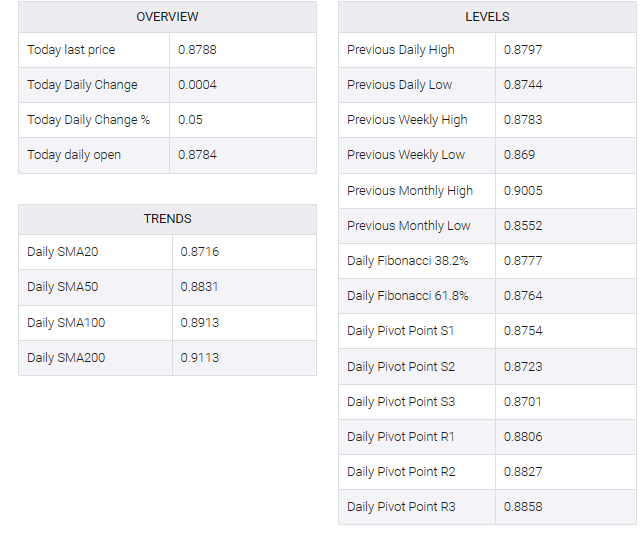

USD/CHF levels to watch

Analyzing the daily chart, the technical outlook for USD/CHF is neutral to bullish, suggesting that bulls are gaining momentum but not yet short-term highs. The Relative Strength Index (RSI) exhibits a bullish bias with an upward slope above its midpoint, while the Moving Average Convergence (MACD) shows neutral green bars. To add to this, the pair is above the 20-day Simple Moving Average (SMA) but below the 100 and 200-day SMAs, suggesting that despite recent bearish sentiment, bulls are still resilient, holding some momentum but bears in the bigger picture. There are commands.

Support levels: 0.8760, 0.8750, 0.8725 (20-day SMA).

Resistance levels: 0.8790, 0.8800, 0.8815.