- Reports Q1 2022’s results on Thursday on Jan. 27, just after the market had closed.

- Revenue Expectation: $118.68 billion

- EPS Expectation: $1.89

In its quarterly earnings report this afternoon, Apple (NASDAQ:AAPL) needs to demonstrate that supply chain interruptions that have hindered the company’s ability to sell more devices are decreasing. In the absence of this, it will be extremely difficult for the world’s highest-valued company to reverse a decline in its stock and prove the investors its ratios remain in a reasonable range.

Apple Weekly Chart

As is the case with the wider market Apple shares Apple have been falling in the last couple of weeks. After reaching a record highest of $182.94 in the beginning of January The iPhone maker fell by around 11% from its price. The company closed at $159.69 per shares on Wednesday.

In October, in the company’s most recent financial report the Chief Executive Officer Tim Cook warned that semiconductor shortages affected almost every item the Cupertino company, based in California, produces in its factories around the world although demand was strong.

In addition, Cook stressed that the shortages, in conjunction with COVID-19 limitations, delayed the delivery of Apple’s flagship iPhones and other popular devices which resulted in an estimated loss of $6 billion in sales potential.

Record Holiday Season

In spite of supply chain obstacles, Apple is still on the right track to record sales for the Christmas season, as analysts predict an rise of 6% to $118.68 billion over the last quarter of this calendar year.

However, there’s a opinion that it’s not going to be the blockbuster quarter Apple originally envisioned. Delivery delays and short-term issues have irked a lot of consumers. In addition, with the rise in inflation, and the Omicron variation bringing new problems, the mood of consumers could be slipping as well.

Based on Bloomberg, Apple told its suppliers in the last month, that iPhone demand was declining.

We believe that these issues are temporary in nature. They don’t conceal it from us that Apple is in a new expansion phase, driven by its most recent iPhone models and the soaring demand for its wearables , other gadgets , as in addition to its service offerings.

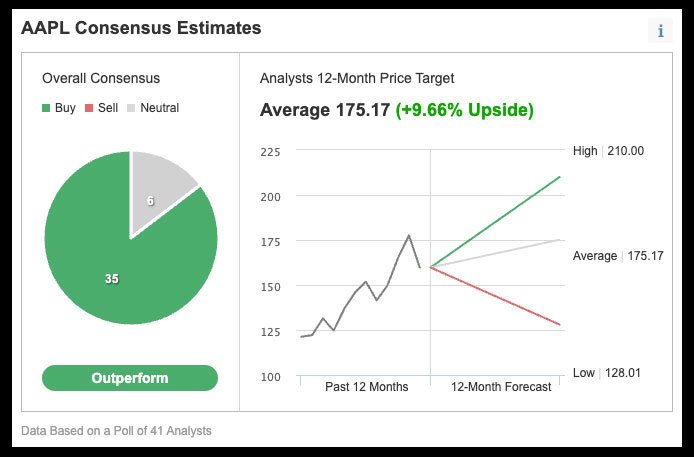

It’s possible that’s the reason the majority of the 41 analysts surveyed by Investing.com recommend investing in Apple shares. Their price target consensus of $175 suggests that they have a 9.66 percent upside.

Apple Consensus Estimates

In a more recent report, analysts from JPMorgan have stated that AAPL shares aren’t affordable in relation to earnings. However, the company’s optimistic outlook for 2022 is likely to keep shareholders content, particularly during the second quarter of fiscal year where iPhone sales could exceed $49.2 billion.

Its note said:

“We believe investors will continue to justify the premium earnings multiple (30x) on expectations of further earnings upgrades, driving the shares higher with the positive outcome from a combination of a modest fiscal, first-quarter beat and a better outlook.”