-

AUD/USD stages a modest recovery from a fresh YTD trough touched earlier this Wednesday.

-

Retreating US bond yields keeps the USD bulls on the defensive and lends support to the major.

-

Bets for one more Fed rate hike limit the USD slide and cap the pair amid China’s economic woes.

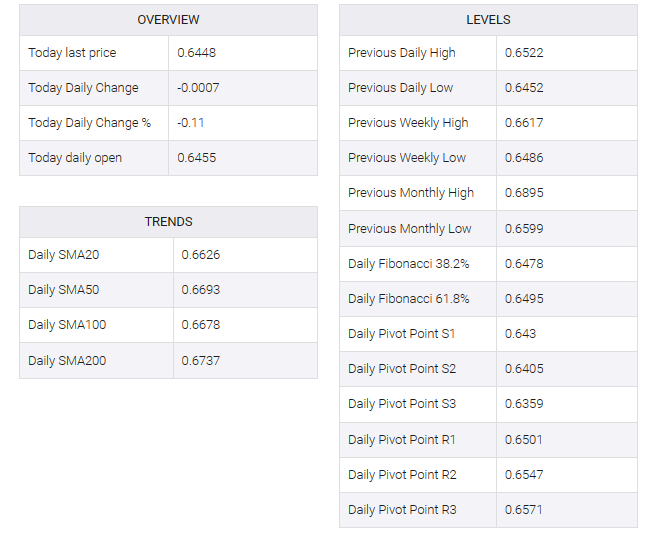

The AUD/USD pair recovers a few pips from the 0.6430-0.6425 area, or a fresh low since November 2022 touched during the Asian session on Wednesday, albeit lacks follow-through. Spot prices currently trade around mid-0.6400s, still in the red for the seventh straight day, and seem vulnerable to prolonging the recent downward trajectory witnessed over the past month or so.

A softer tone around US Treasury bond yields put US dollar (USD) bulls on the defensive below more than two-month highs on Monday, which, in turn, appeared to lend some support to the AUD/USD pair. Apart from this, the Relative Strength Index (RSI), which is slightly oversold on the daily chart, prompts traders to lighten their bearish bets and contributes to the mid-intraday bounce. The USD remains on the downside given growing acceptance that the Federal Reserve (Fed) will keep interest rates on hold for longer.

It is noteworthy that the US central bank is expected to pause the rate-hiking cycle at its upcoming policy meeting in September. However, markets are still pricing in the possibility of another 25 bps lift-off by the end of this year, and bets were reaffirmed by upbeat US retail sales data released on Tuesday, which indicated that consumer spending held up well in July. This, in turn, could act as a tailwind for US bond yields and the USD, which should cap gains for the AUD/USD pair, along with concerns over China’s worsening economic conditions.

Another round of disappointing Chinese macro data released on Tuesday fueled concerns that the post-Covid recovery in the world’s second-largest economy has slowed after a fast start in the first quarter. Even as a surprise rate cut by the People’s Bank of China (PBoC) does little to boost investor confidence, the China-proxy is taking some precautions before placing bullish bets around the Australian dollar (AUD). Hence, any meaningful recovery requires strong follow-through buying to confirm that the spot price has made a near-term bottom and position.

Market participants are now looking to the US economic docket, including the release of building permits, housing starts and industrial production figures in the first North American session. This, along with US bond yields and broader risk sentiment, could impact USD price dynamics and provide some impetus to the AUD/USD pair. The focus, however, will remain glued to the FOMC meeting minutes, which will be watched for clues about the Fed’s future rate-hike path and help determine the near-term trajectory for the greenback.