-

AUD/USD loses ground near 0.6572 on the stronger US Dollar.

-

US Nonfarm Payrolls (NFP) for November rose by 199K vs. 150,000 prior, above expectations.

-

The downbeat Chinese CPI and PPI data weigh on the Australian Dollar.

-

Investors await the RBA’s Bullock speech and US CPI data on Tuesday.

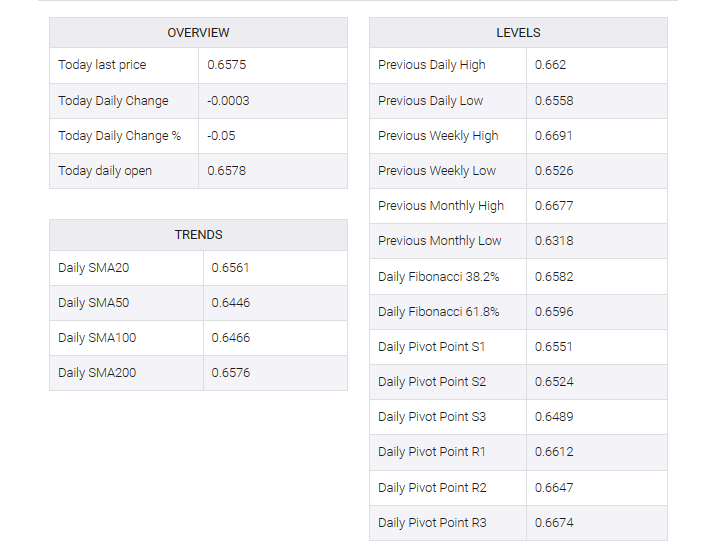

The AUD/USD pair edges lower below the 0.6600 barrier during the early Asian session on Monday. The upbeat US Nonfarm Payrolls data lift the US Treasury bond yields and the US Dollar (USD). The pair currently trades around 0.6572, down 0.09% on the day.

Data from the US Bureau of Labor Statistics (BLS) reported on Friday that US nonfarm payrolls (NFP) for November rose by 199,000 from an increase of 150,000 in October and came in above market expectations of 180,000. Meanwhile, the unemployment rate fell to 3.7% from 3.9% over the same period. Average hourly earnings were flat at 4.0%, in line with market expectations. Finally, the preliminary University of Michigan consumer sentiment index for December rose to 69.4 from the previous reading of 61.3, the second highest reading this year.

The job market appears resilient after a year of recessionary worries. Futures market pricing suggests the Fed will end its rate-hiking cycle and start cutting rates next year. However, the market lowered expectations of the first rate cut after employment data from March to May. The Fed will hold its two-day policy meeting, starting on Tuesday. Investors will take cues from how officials view the economy.

On the Aussie front, the Australian Bureau of Statistics revealed last week that the country’s trade surplus narrowed to 7,129M in October, below market estimates of 7,500M from a previous reading of 6,184. However, inflation concerns in China and weaker than expected Consumer Price Index (CPI) and Producer Price Index (PPI) put some selling pressure on the China-proxy Australian Dollar (AUD).

Market players will keep an eye on the Reserve Bank of Australia (RBA) Governor Bullock’s speech on Tuesday and the US CPI data due on Tuesday. The attention will shift to the two-day policy Fed meeting on Tuesday and Wednesday. This event could trigger volatility in the market and give a clear direction to the AUD/USD pair.