-

AUD/USD falls to near 0.6400 as the appeal for the US Dollar improves.

-

The US Dollar strengthens ahead of Powell’s speech.

-

RBA Bullock kept hopes of further rate-tightening alive, citing that the progress in inflation declining to 2% has slowed.

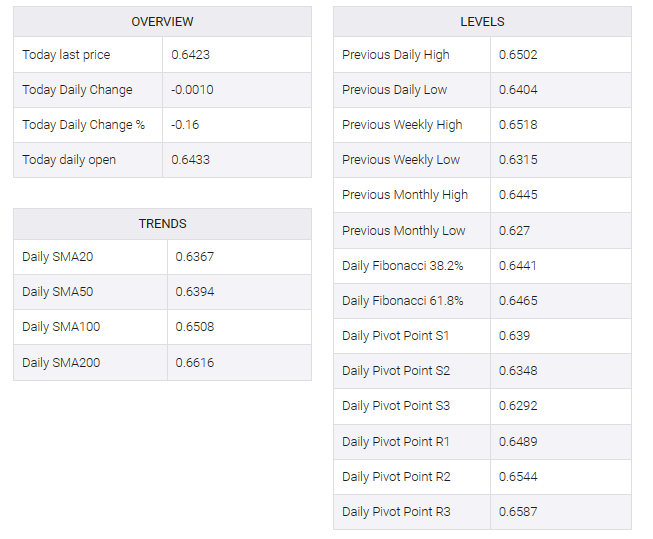

The AUD/USD pair is declining toward the round-level support of 0.6400 in the early New York session. The Aussie asset is expected to continue its downside trend as the appeal for safe-haven assets has improved. The US Dollar recovers further as Federal Reserve (Fed) policymakers see the need for more interest rate hikes to tame inflationary pressures comfortably.

Fed policymakers: Michelle Bowman and Neil Kashkari cited persistent inflation risks from a stagnant US economy when giving guidance on interest rates on Tuesday. Fed Bowman sees the need for more policy hikes as the current tightening financial environment has been contributed to by deliberately high bond yields, which may not remain elevated for long.

The S&P500 opened on a cautious note as investors worried ahead of interest rate guidance from Fed Chair Jerome Powell. Investors are confused as to whether Jerome Powell will discuss the need for further policy tightening to stabilize cement prices, or put little emphasis on keeping the current policy tight for longer.

The US Dollar Index (DXY) gathered strength to retake immediate resistance at 106.00 even as investors saw the Fed raising interest rates. A tight U.S. labor market is beginning to ease as business investment weakened last quarter due to higher borrowing costs.

Meanwhile, the risk of escalating Middle East tensions is down as market participants remain in conflict between Israel and Palestine.

The Australian Dollar failed to gain strength despite an interest rate hike from the Reserve Bank of Australia (RBA) on Tuesday. The RBA raised its Official Cash Rate (OCR) by 25 basis points (bps) to 4.35%. RBA Governor Michele Bullock kept hopes of further rate-tightening alive, citing that the progress in inflation declining to 2% has slowed and risks of persistent consumer inflation have escalated.