-

AUD/USD extends its downside following RBA Governor Bullock’s speech.

-

Reserve Bank of Australia (RBA) Governor said CPI was higher than expected, but was about where it would come.

-

The September’s US New Home Sales rose to 759,000 MoM, above the market consensus of 680,000.

-

Market players await the first US Q3 Gross Domestic Product estimate, Initial Jobless Claims, and Durable Goods Orders.

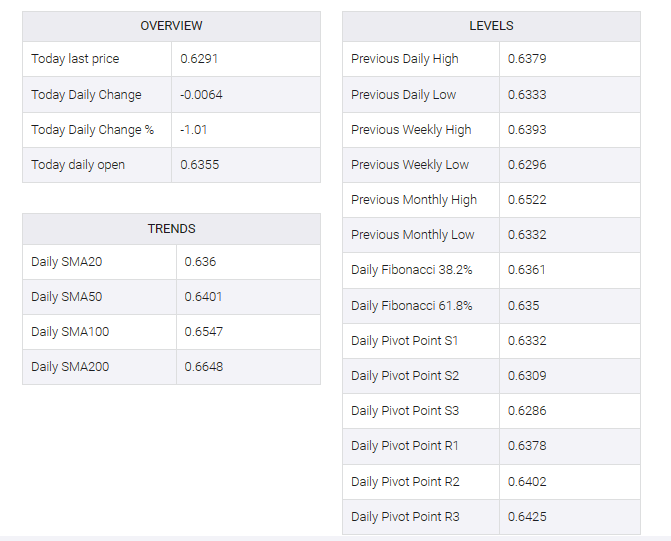

The AUD/USD pair attracted some sellers during early Asian trading hours on Thursday. The pair broke below the 0.6300 mark and is currently trading near 0.6290, losing 0.28% for the day. A risk-off sentiment and a strong US dollar (USD) weighed on the pair.

Earlier on Thursday, Reserve Bank of Australia (RBA) Governor Michelle Bullock said CPI was slightly higher than expected, but we thought it was about where it would come from. Bullock added that the central bank aims to slow the economy without pushing it into recession.

The Australian Consumer Price Index (CPI) reached 1.2% QoQ in the third quarter of 2023, compared to the 0.8% increase seen in the second quarter. Market consensus was for an increase of 1.1% during the said period. On an annualized basis, CPI inflation rose to 5.4% in the 3rd quarter of 2023, against an expected 5.3% increase and an earlier print of 6.0%.

On the US dollar front, September new home sales in the US rose to 759,000 MoM, above the market consensus of 680,000. The greenback’s upside is bolstered by higher US Treasury yields and a risk-off mood. Meanwhile, US Treasury bond yields edged higher, with the 10-Y US Treasury yield rising to 4.96%.

Additionally, geopolitical risks will continue to fuel safe haven flows. Earlier on Thursday, Prime Minister Benjamin Netanyahu said Israel was preparing for a ground attack on Gaza and that the timing of the attack would be reached by consensus.

Moving on, the Australian Export and Imports Price Index for the third quarter (Q3) is scheduled to be released in the Asian session on Thursday. Market participants will closely monitor the first Q3 Gross Domestic Product estimate on Thursday, which is expected to show a 4.2% expansion. Also, Initial Jobless Claims and Durable Goods Orders will be released.