-

AUD/USD remains under some selling pressure for the fourth successive day on Thursday.

-

China’s economic woes and RBA rate cut bets weigh on the Aussie amid the recent USD rally.

-

Dovish Fed expectations might cap any further USD gains and lend some support to the pair.

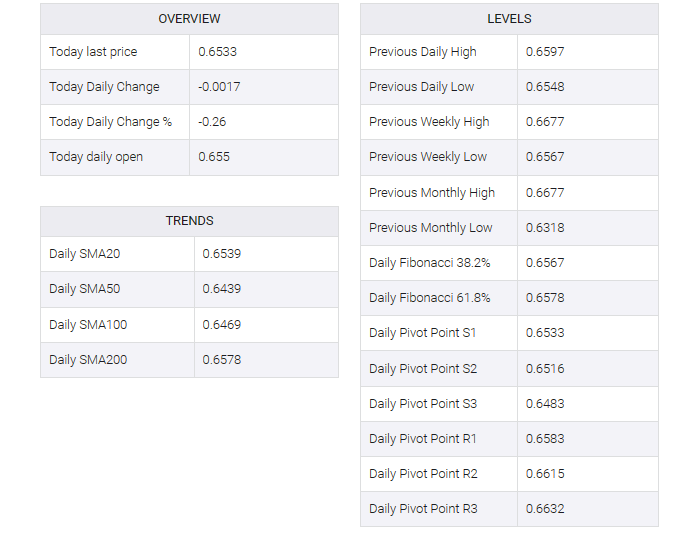

The AUD/USD pair turns lower for the fourth straight day following an early uptick to the 0.6555-0.6560 area and drops to over a two-week low during the Asian session on Thursday. Spot prices remain depressed near the 0.6530 region and move little in reaction to the mixed Chinese trade data.

China’s General Administration of Customs (CGAC) reported that the trade surplus jumped to $68.39 billion in November from $56.53 billion. Additional details of the report indicate that exports rose unexpectedly by 0.5% in the reported month. That said, imports missed consensus estimates by a wide margin and fell 0.6% in November, fueling concerns about weak domestic demand. It comes on top of Moody’s cuts to China’s credit outlook, state-owned firms and banks, further eroding investor appetite for riskier assets.

This, coupled with Australian trade data and growing bets for a rate cut by the Reserve Bank of Australia (RBA) around August/September 2024, weakened the China-proxy Australian dollar (AUD). Meanwhile, a weaker risk tone helped the safe-haven US dollar (USD) preserve its recent strong gains from the two-week high touched on Wednesday, contributing to the suggested tone around the AUD/USD pair. That said, dovish Federal Reserve (Fed) expectations put a lid on any further USD gains and provide some support to the major.

Investors are convinced that the US central bank is done with its policy tightening campaign and are now pricing in a greater chance of a 25 bps rate cut at the March policy meeting. The bets were reaffirmed by incoming US data, which suggested that a historically tight labor market may be easing. This, in turn, warrants some caution for aggressive traders and before positioning for an extension of the AUD/USD pair’s recent sharp pullback from around the 0.6700 mark, or touching a four-month high on Monday.

Market participants now look to the release of general weekly initial jobless claims data from the US for some inspiration later in the North American session. Focus, however, will stick to the closely watched US monthly employment data, known as Friday’s NFP report. The data will provide new signals about the US labor market and influence the Fed’s policy outlook, which, in turn, will drive USD demand and give a new directional impetus to the AUD/USD pair.