-

US consumer inflation declined more than expected in November.

-

US Dollar Index slides to its lowest level since July 27.

-

The AUD/USD holds firm, maintaining important weekly gains.

During the American session, the AUD/USD pair rose to 0.6824, reaching its highest intraday level since July, driven by broad-based Dollar weakness. It is holding onto its weekly gains, remaining near 0.6800.

Mixed US data: inflation approaches Fed’s target

The latest key US economic report for 2023 showed that the core personal consumption expenditure price index (core PCE) rose 0.1% in November, below the market consensus of 0.2%. Headline PCE declined for the first time since 2020. Another report indicated a 5.5% increase in durable goods orders in November, and the University of Michigan’s consumer sentiment index rose to 69.7 from 69.4 in December.

Market reaction to the US data was limited. The numbers point to a strong economy and inflation near the Federal Reserve’s target. Following the data, easing expectations rose, while US Treasury yields remained relatively stable.

The US dollar index (DXY) fell to 101.42, its lowest level since July, with AUD/USD nearing 0.6825. The Australian dollar held above 0.6800, set for its second consecutive weekly gain, reaffirming the bullish outlook. However, risks remain as US economic performance could lead to the Fed cutting interest rates after other central banks, including the Reserve Bank of Australia (RBA).

Technical outlook

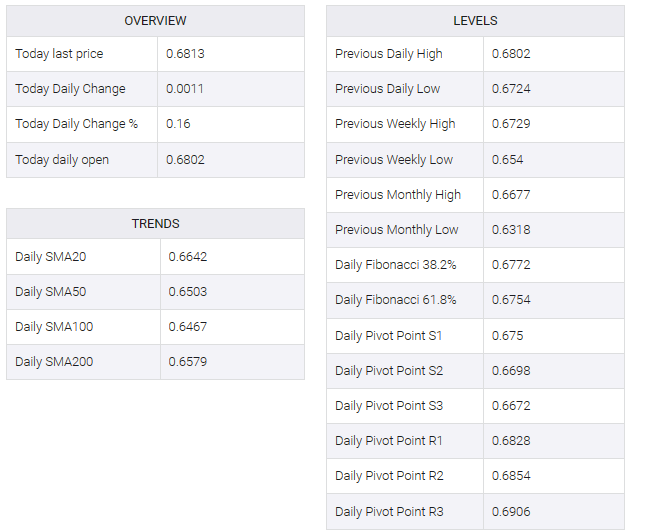

The AUD/USD remains within an ascending channel on the daily chart; however, it is nearing the upper limit, which could potentially limit the rally and prompt a period of consolidation. Conversely, a breakout above the upper limit at 0.6830 could trigger acceleration, targeting 0.6850.

In the event of a downward correction, initial support may be found around the 0.6770 area, followed by 0.6725. If it falls below 0.6600, the outlook would shift from bullish to neutral/bearish.