-

AUD/USD hovers around 0.6823 amid light trading volume on Wednesday.

-

The US Core Personal Consumption Expenditures Price Index (Core PCE) for November rose 0.1% MoM and grew 3.2% YoY.

-

RBA minutes indicated that any further tightening will depend on the incoming data.

-

December’s US Richmond Fed Manufacturing Index will be released on Wednesday.

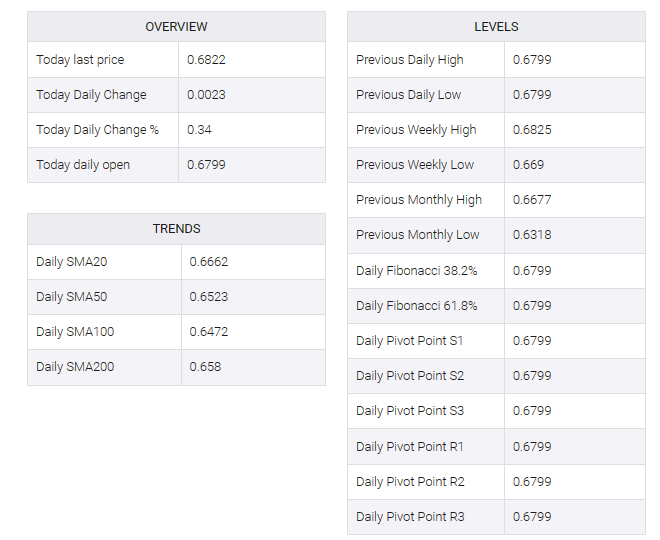

The AUD/USD pair posted slight losses during the early Asian session on Wednesday. However, the pair’s downside remains limited as a dovish Fed narrative could keep the US dollar (USD) under pressure. Markets will remain calm amid thin trading in the last week of the year. AUD/USD is currently trading near 0.6823, down 0.02% on the day.

On Tuesday, the US Dallas Fed Manufacturing Business Index for December came in at -9.3 vs -19.9 previously. Meanwhile, November’s Chicago Fed national activity index rose to 0.03 from a previous reading of 0.49 drops. The Philly Fed non-manufacturing index improved to 6.3 in December from a fall of 11.0 in the previous reading.

The US Bureau of Economic Analysis released Friday that the November core personal consumption expenditures price index (core PCE) rose 0.1% MoM and rose 3.2% YoY. Markets reacted little to the report. The Federal Reserve (Fed) is not yet ready to declare victory over inflation, but a slowdown in core inflation opens the door to lowering the Fed funds rate in 2024. However, timing will be determined by key PCE figures in the coming months.

On the Australian front, minutes from the Reserve Bank of Australia (RBA) suggested the central bank may raise rates again despite noting “encouraging signs” of easing inflationary pressures in the economy. The minutes added that further tightening would depend on whether incoming data changes the economic outlook and the growing assessment of risks.

Later this week, the US Richmond Fed Manufacturing Index for December will be released on Wednesday, and the weekly Initial Jobless Claims will be due on Thursday. The financial markets will stay relatively quiet ahead of the New Year holiday.