-

AUD/USD grinds higher around intraday tops, braces for biggest daily gain in a week.

-

Upbeat MACD signals keeps buyers hopeful but 200-EMA holds the gate for bear’s exit.

-

Aussie pair sellers remain off the table beyond 0.6650.

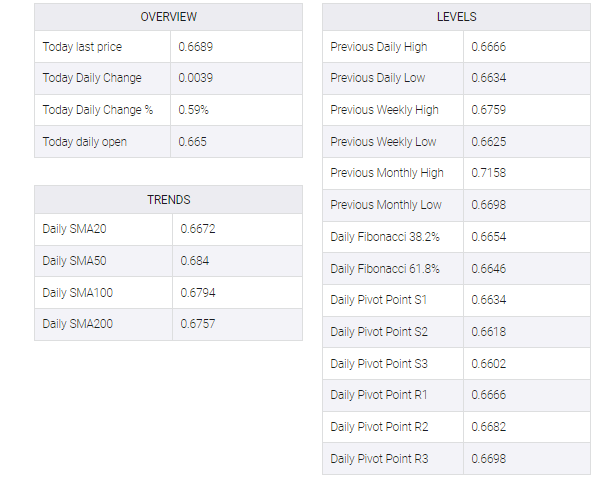

AUD/USD seesaws around the intraday high of around 0.6700 as the bulls jostle with the 100-bar Exponential Moving Average (EMA) during early Tuesday. In doing so, the Aussie pair grinds higher within a three-week-old symmetrical triangle.

It’s worth noting that the bullish MACD signals favor AUD/USD pair buyers to cross the immediate 100-EMA resistance of around 0.6700.

However, the 200-EMA hurdle of 0.6736 could act as an additional upside filter for the pair buyers before pushing back the bears.

Above all, the monthly high near 0.6785 appears the last defense of the AUD/USD bears.

Alternatively, pullback moves remain elusive unless the quote stays inside the aforementioned triangle, currently between 0.6710 and 0.6645.

If the quote remains bearish after 0.6645, a bearish towards the monthly low of 0.6564 cannot be ruled out. On the downside, the 0.6700 round figure can act as an intermediate stop.

Overall, AUD/USD tempts buyers but needs validation of upside momentum from 200-EMA barrier.

On a different page, a break in the market’s risk-on mood seems to challenge AUD/USD buyers, apart from the aforementioned technical indicators.

AUD/USD: Four-hour chart

Trend: Limited upside expected