-

AUD/USD sold off on dovish RBA tone and US-China concerns over Taiwan.

-

RBA hikes key rates by 50 bps but says it’s not on a pre-set tightening path.

-

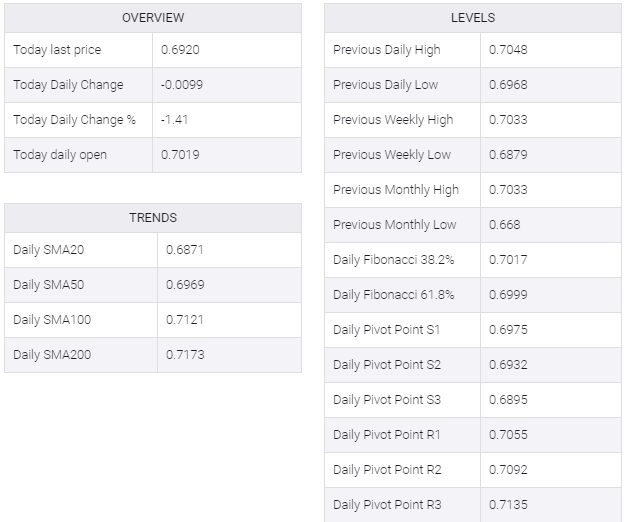

A potential rising channel breakdown on the 1D targets 21 DMA at 0.6873.

AUD/USD is holding the lower ground above 0.6900, losing nearly 1.50% on the day, as the AUD bulls continue to face a double-whammy this Tuesday.

Risk-aversion remains in full steam, as markets remain jittery ahead of US House Speaker Nancy Pelosi’s expected visit to Taiwan around 1430 GMT. The US has remained unfazed by the Chinese threat but Beijing and Taipei stepped up their military response in a show of force, as Pelosi visited the self-governing island claimed by the Dragon Nation.

Another reason for the Australian sell-off is the dovish signal from the Reserve Bank of Australia (RBA) during its monetary policy meeting. The RBA this month raised key rates by 50 bps to 1.85%, as widely expected. However, the central bank signaled that it was not on the path of tightening previously planned, abandoning forward guidance, which triggered a fresh fall in the Australian dollar.

All eyes now remain on Pelosi’s arrival to Taipei, which could see a fresh risk-aversion wave spelling out in the early American session. Meanwhile, the pair also remains exposed to downside risks, given that it is on track to confirm a rising wedge breakdown on the daily chart.

AUD/USD has breached the horizontal 50-Daily Moving Average (DMA) support at 0.6966, which has opened up the additional downside.

A daily closing below the rising trendline support at 0.6952 will validate the bearish channel.

The next relevant downside cap is pegged at 0.6873, which is the horizontal 21 DMA.

The 14-day Relative Strength Index (RSI) is attacking the midline, suggesting that there is more room southwards.

AUD/USD: Daily chart

Recapturing the 50 DMA is critical to initiating any meaningful recovery towards 0.7000.

The intraday high of 0.7034 will emerge as a tough nut to crack for AUD bulls.