-

AUD/USD aims for more upside amid risk-on mood.

-

The USD Index faces an intense sell-off due to easing US consumer inflation.

-

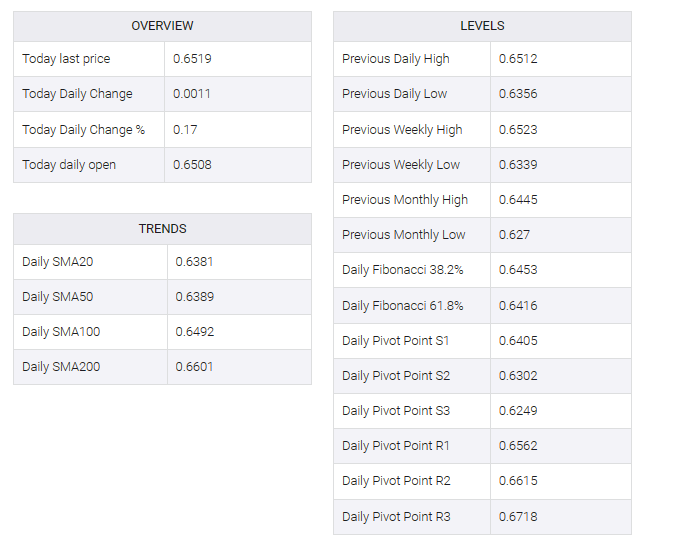

AUD/USD aims to climb above the immediate resistance plotted from 0.6520.

The AUD/USD pair faced pressure around 0.6520 in the late European session. Australian assets stalled as investors awaited US retail sales data for October, due out at 13:30 GMT.

Consumer spending fell 0.3% against a 0.7% rise in September, according to consensus. Weaker consumer spending data will put further pressure on the US dollar. The US dollar faced a sell-off as consumer inflation eased in the US economy.

October’s US inflation report indicated that headline inflation rose at the slowest pace in more than two years. Annual headline CPI rose 3.2%, softening from estimates of 3.3% and an earlier reading of 3.7%.

AUD/USD aims to break above the immediate resistance plotted from August 15 near 0.6520. The asset aims to stabilize above the 50-day exponential moving average (EMA), which is trading near 0.6420, indicating that the near-term trend is bullish.

The Relative Strength Index (RSI) (14) attempts to move into the bullish range of 60.00-80.00. If RSI (14) can do that, Australian dollar bulls will get stronger.

A decisive break above 0.6522 on August 15 would take the asset to an August 9 high of 0.6571. A breach of the latter would propel the asset towards the August 10 high at 0.6616.

On the upside, fresh downside could be seen if Australian assets dip below 0.6286 on Oct 03. It will reveal assets at 0.6212 on 21 October 2022, then a low of 0.6170 on 13 October 2022.