-

AUD/USD takes offers to refresh yearly bottom during seven-day downtrend.

-

Sustained downside break of key support line, bearish MACD signals favor Aussie sellers.

-

Descending trend line from March, oversold RSI (14) suggests limited downside room.

-

Fed Minutes need to push back policy pivot concerns to keep AUD/USD on bear’s radar.

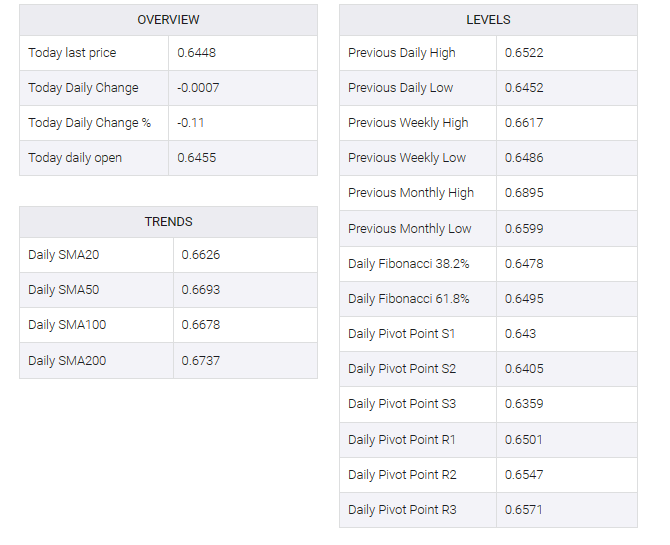

AUD/USD stands on slippery ground near 0.6430 as it renewed a year-to-date (YTD) low during a seven-day losing streak early Wednesday. In doing so, the Aussie pair justifies its risk barometer status ahead of the Federal Reserve’s (Fed) monetary policy meeting minutes.

Also read: AUD/USD settles at yearly lows amid sour sentiment ahead of Fed minutes mid-0.6400s

Adding strength to the negative bias is the bearish MACD signal and a clear break of the previous key support line quote extending from October 2022. Moreover, the Aussie pair sustained below the 10-DMA and also supported a one-month-old downtrend. AUD/USD sellers.

However, the oversold condition of the RSI (14) and possible pessimism for US dollar hawks from the Fed minutes seem to be prompting AUD/USD sellers as they near a downward-sloping support line from March, last near 0.6410.

In a case where AUD/USD ignores the RSI and hawkish Fed minutes are justified, if any, the quote is likely to drop to a late 2022 low around 0.6170.

On the other hand, the 10-DMA caps the Aussie pair’s immediate recovery around 0.6515.

However, a convergence of the 61.8% Fibonacci retracement from October 2022 to February 2023, a 10-month-old previous support line and a downward-sloping trend line from July 18 together form key resistance for buyers to see the 0.6545-50 pair during the quote’s rebound.

Should the quote manages to stay firmer past 0.6550, lows marked during late June and early July around the 0.6600 mark will act as the last defense of the Aussie bears.

AUD/USD: Daily chart

Trend: Limited downside expected