-

Australian Dollar remains silent below a major level ahead of the RBA interest rate decision.

-

Australia’s central bank is expected to increase interest rates by 25 basis points.

-

China’s Trade Balance is anticipated an increase to $81.95B from $77.71B prior.

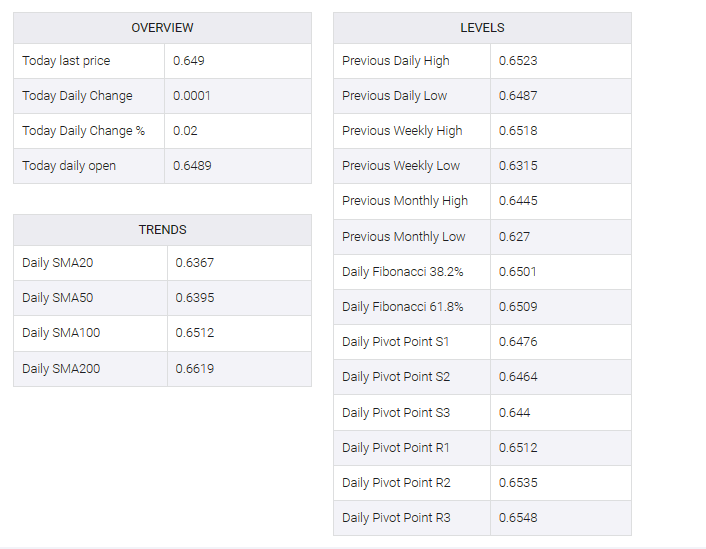

AUD/USD hovered around 0.6490 during the Asian session ahead of the Reserve Bank of Australia’s (RBA) interest rate decision which will be released at 03:30 GMT. The pair suffered losses in the previous session due to US Treasury yields, which helped the US Dollar Index (DXY) trade near a two-month low of 105.20. However, at the time of writing, the 10-year US bond yield is hovering in negative territory at 4.63%.

Australia’s central bank is widely expected to raise rates by 25 basis points, likely in response to recent consumer price index (CPI) data. The third quarter of 2023 grew at 1.2%, beating the market consensus of 1.1%. Furthermore, Australia’s seasonally adjusted retail sales (MoM) for September beat expectations, with a reading of 0.9% compared to the market consensus of 0.3%.

Market participants will likely focus on Governor Michelle Bullock’s recent hawkish stance, suggesting a possible interest rate hike in the future. In addition, the major Australian banks—ANZ, CBA, Westpac, and NAB—adjusted their predictions for RBA rate hikes in light of resurgent inflation and taunts from RBA policymakers.

On the other hand, Minneapolis Federal Reserve Bank President Neil Kashkari revealed in an interview Monday with the Wall Street Journal that, when it comes to monetary policy, he leans very cautiously, preferring to be overly tight rather than risk not doing enough. To align inflation with the central bank’s 2% target.

Moreover, traders also await China’s Trade Balance data for October on Tuesday, with expectations of a rise to $81.95B, up from the previous figure of $77.71B. A greater-than-expected increase in the Trade Surplus could positively influence the AUD/USD pair, given Australia’s significant role as one of China’s major trade partners.