-

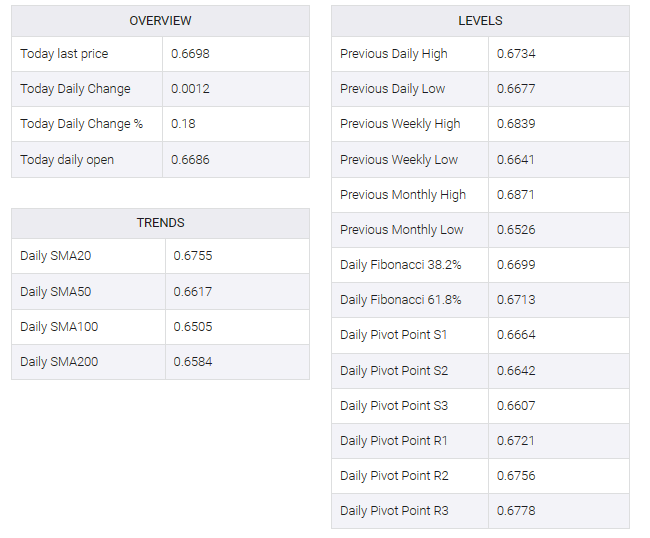

AUD/USD aims stability above 0.6700 ahead of us Inflation data.

-

A sharp decline in the Australian monthly CPI indicates that the RBA’s ‘rate-tightening’ campaign has come to an end.

-

Investors await the speech from Fed Williams for further guidance on interest rates.

The AUD/USD pair struggled to hold above the round-level support of 0.6700 in the late European session. Australian assets accounted for the bulk of intraday gains as the US Dollar Index (DXY) came under pressure ahead of US Consumer Price Index (CPI) data for December.

The S&P500 is expected to open on a subdued note considering overnight futures. Market mood may be cautious as investors await US CPI data, which will guide further moves in the FX domain. The USD index was slightly lower around 102.50 and the 10-year US Treasury yield fell to 3.99%.

Investors will focus closely on US inflation data as it will indicate whether the Fed will discuss cutting interest rates from March. Monthly and core headline inflation rose 0.2% and 3.2%, respectively, according to preliminary consensus. The monthly core CPI rose at a steady pace of 0.3% while the annual data fell to 3.8% from the previous reading of 4.0%.

If the inflation report turns out hotter-than-projected, bets in favour of rate cuts from March would ease further. As per the CME Fedwatch tool, the chances for first rate cut in March are at 66% from 90% a week ago.

Meanwhile, investors await the speech from New York Fed Bank President John Williams, which is expected at 20:15 GMT. Investors will keenly watch whether Fed Williams will maintain a restrictive interest rate stance or shift to endorsing early rate cuts.

On the Australian Dollar front, a sharp fall in monthly Consumer Price Index (CPI) has strengthened hopes that the Reserve Bank of Australia (RBA) has reached to an endgame. The monthly CPI data softened to 4.3% against expectations of 4.4% and the prior reading of 4.9%.