The article was created especially for Investing.com

- WTI crude oil eclipses October 2021 high

- Brent crude oil is moving over the long-term technical resistance

- US energy policy feeds the bull market in oil.

- OPEC+ has only one goal – to raise prices

- Geopolitics could trigger upswings in prices in 2022.

A small percentage of vehicles that travel on US highways is electric and, though the figure is increasing every year, gasoline-powered cars dominating the marketplace. In the United States, US is the top oil consumer on a per-capita basis. Yet, China and India account for more than one third percent of all the people in this world. They are significant consumption of crude oil.

As the world tackles climate change and encourages more use and production of renewable and alternative fuels, demands for oil and other oil products is increasing. However, US production is lower in the early 2022 period than it was during the peak in March of 2020. Based on the Energy Information Administration, daily US output dropped from an record 13.1 million barrels of oil per daily in the month of March. US energy policy during the Biden administration has been the primary reason for the 11.5 percent decrease in production that isn’t an effect of the current global demand changes.

The lower US oil production has put price pressures on the market. In the last week Brent and WTI crude oil futures reached new multi-year highs. It is not likely to be long before prices climb over the $100 per barrel mark that was the highest price since 2014.

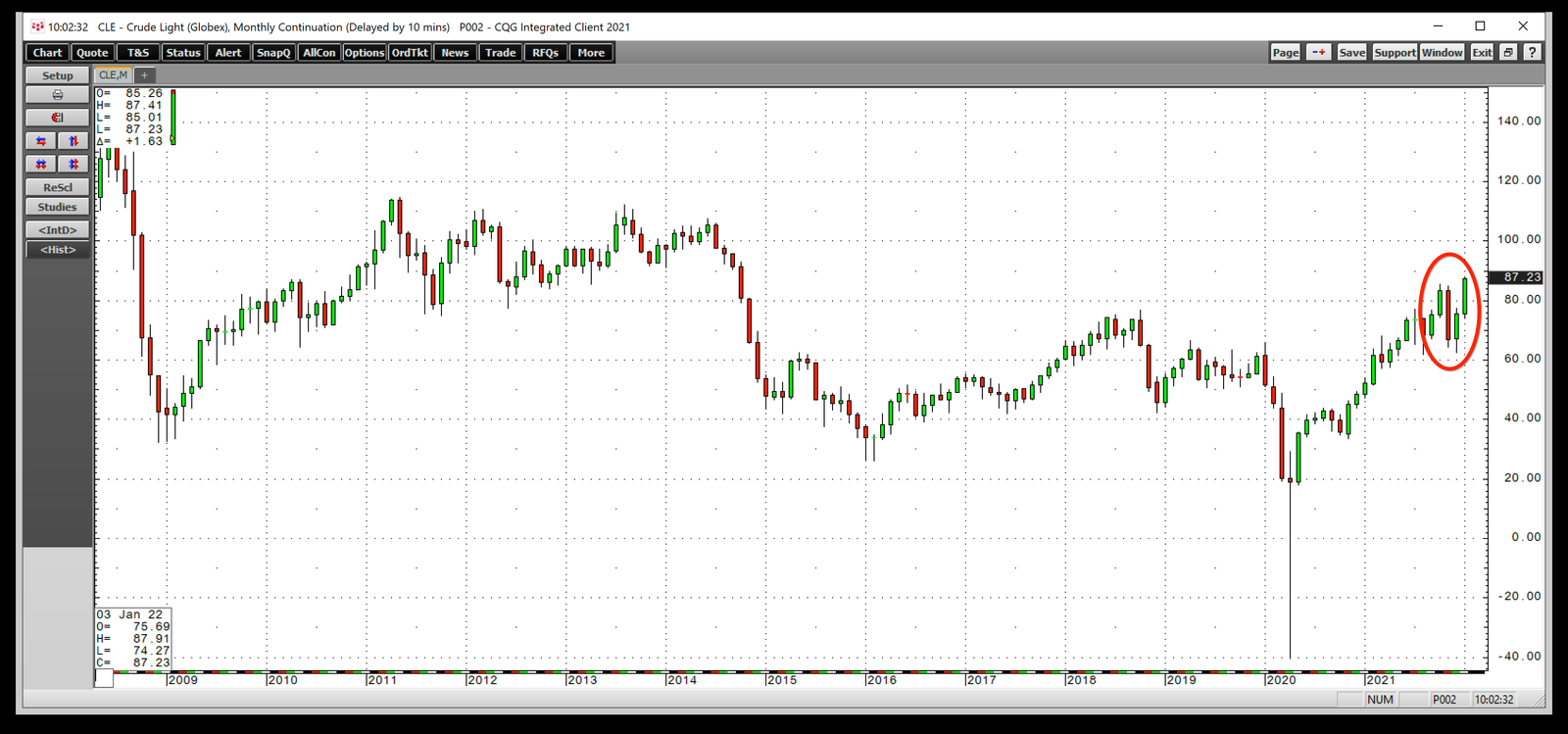

WTI Crude Oil Eclipses October 2021 High

NYMEX crude oil contracts climbed to the most expensive price since 2014 in the latter half of October 2021. At that point, they lost their upward momentum at $85.41. A dramatic correction and a steep downhill slide brought the price to a record low that was $62.43 per barrel at the beginning of December which was an increase of 26.9 percent decline.

Source: CQG

The monthly chart reveals the correction that came up just short of a test of the low in August 2021 of $61.74 which is a crucial technical support level for technical support.

NYMEX crude oil has returned to the bullish path. This week, the price was over the high of late October and climbed by $87.91 per barrel, and was above the $87 mark on January. 26. The NYMEX futures also made an upward move however, the biggest change occurred from Brent futures. Brent Futures.

Brent Crude Oil Moves Above Long-Term Technical Resistance Level

As WTI futures reached the highest level since October 2014, Brent futures remained below the crucial technical resistance level of the peak in 2018. This week Brent has caught up to the other benchmark price in the world.

Source: Barchart

The chart illustrates the resistance level that was at the October 2018 peak of $86.74. Brent futures climbed to the latest highest that was $90.02 per barrel. It could indicate an entry point towards the $100 threshold. The next level of technical resistance over the current high is at $115.71 per barrel, which is the high in June of 2014.

WTI as well as Brent futures are currently in lockstep bullish price patterns , with their goals at three-digit oil prices.

US Energy Policy Is Feeding The Oil Bull

The Biden administration ran with a focus on climate change. In his first day in the office, in January of 2021 Biden announced that President Joseph Biden ended his Keystone XL pipeline project that transports crude oil from oil sands of Alberta, Canada, to Steele City, Nebraska, and on to the NYMEX distribution point at Cushing, Oklahoma.

On May 20, 2021 the president has banned drilling and fracking to extract gas and oil on federal land in Alaska.

The green energy program promotes renewable and alternative sources of energy, and also reduces the production and consumption of fossil fuels. But, the vast majority of vehicles within the US are powered by gasoline, and China as well as India continue to need ever-increasing amounts of hydrocarbons to energy.

The US several decades to surpass Saudi Arabian and Russian oil production to be energy independent. By 2021 US policies on energy handed over the power of pricing over to energy cartels as well as Russia. The US administration requested OPEC+ to boost production twice because the price of gasoline was rising. Two times OPEC+ refused, leading to the release of 50 million barrels US crude oil out of the reserve of strategic petroleum. Five million barrels equals just three days of what the US demands. Although crude oil dropped following the SPR release, it rebounded and reached an increase to a new high.

US policies on energy have increased inflationary pressures, increasing the price of energy in the early 2021s.

OPEC+ Has Only One Mission – Higher Prices

In the year 2016 Russia was more interested and active with OPEC strategy, which has expanded Russian Russia’s President Vladimir Putin’s influence within the Middle East. Since then, the cartel can not have a decision regarding production policies without Moscow’s support.

The goal of OPEC+ is to get the highest possible price for oil while balancing demand and supply. The lower US output has reduced worldwide supplies, while demand has increased significantly. As of the month March in 2020 US everyday crude oil production increased to a new record 13.1 million barrels in the past US administration. Based on the Energy Information Administration, US production reached 11.6 millibars per day during the week ended on January. 21st of 2022. This was 11.5 percent lower than the record-setting peak.

After years of being stricken by the pressure of rising US production of shale, it is time to pay back since US energy policy restricts production. The main point is that the oil cartels of the world would rather sell a barrel for $100 rather instead of two barrels for $50.

Geopolitics Could Cause Upside Price Spikes In 2022

US policies on energy, increasing inflation, a robust global demand and OPEC+’s need to increase prices are all positive in the case of crude oil. The price is likely to trade in triple-digits by 2022. Oil has traditionally gone up and down stairs, and an elevator lower in price corrections, which we observed during the period from late October to the first week of December.

The geopolitical landscape suggest that an opportunity to ride an elevator in 2022 could be more feasible.

The simmering tensions between US and Europe against Russia and Europe, which includes over 100,000 Russian troops swarming on the Ukraine border, have created the greatest potential for war or hostilities in Europe following the conclusion in the Cold War. A Russian invasion could cause oil prices to increase.

Everyday, Iran comes closer to possessing a nuclear weapon increasing the likelihood of conflict in the Middle East. It is believed that the Straits of Hormuz are a crucial chokepoint in the logistics of crude oil in the region that holds more than half of the world’s reserves. Iran along with Russia are close allies as well Iran along with Saudi Arabia are mortal enemies. The tensions between the Middle East are another front for the US and Russia as well as China preferring a result that keeps oil flowing to the world’s largest nation.

The geopolitical temperatures have risen as have oil price, which is expected to react to developments over the next couple of months and weeks. The geopolitical odds continue favor the upside of this energy-related commodity.

I am expecting to see crude oil at or above the $100 mark by 2022. In addition, if the geopolitical environment continues to be hot, we could witness a challenge to the record-setting 2008 high in the amount of $147.27 for WTI Futures, in addition to $147.50 in Brent futures. In the meantime, rising oil prices will increase inflationary pressures across the globe.