-

EUR/GBP posts modest losses around 0.8670 on Wednesday.

-

The UK S&P Global PMI arrived at 46.2 vs. 46.4 prior, below the consensus.

-

The Eurozone HCOB Manufacturing PMI climbed to 44.4 in December 2023 from 44.2 in November, beating the expectation.

-

Traders will take more cues from the release of German employment data, due on Wednesday.

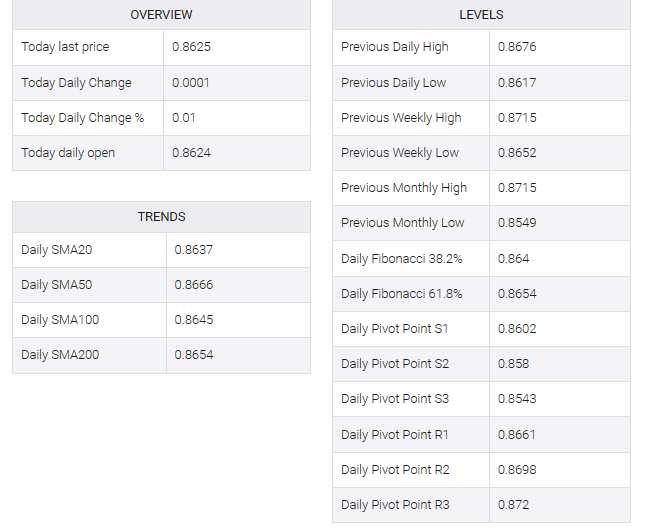

The EUR/GBP cross sticks to the range-bound theme between 0.8665-0.8675 during the early European session on Wednesday. Investors await the German employment data for December. The unemployment rate is estimated to remain steady at 5.9%. The cross currently trades near 0.8670, losing 0.02% on the day.

Activity in the UK manufacturing sector worsened in December 2023. UK S&P Global PMI came in at 46.2 from the previous reading of 46.4, below market consensus. Furthermore, the negative outlook on the British economy and fears of a technical slowdown put some selling pressure on the British Pound (GBP) and acted as a tailwind for the EUR/GBP cross.

On the euro front, the eurozone HCOB manufacturing PMI rose to 44.4 in December 2023 from 44.2 in November, beating expectations. Meanwhile, the German manufacturing PMI came in better than market expectations, rising to 43.3 in December from a previous reading of 43.1.

German employment data, including the unemployment rate and unemployment changes, will be released later on Wednesday. On Thursday, the Eurozone HCOB Composite PMI, Services PMI and Consumer Price Index (CPI) for December will be released. These reports can give a clear direction to the EUR/GBP cross.