-

The EUR/GBP mildly softened to 0.8570, seeing mild losses,

-

Daily chart indicators signal strong bearish momentum; RSI hints continue standing near overbought conditions while MACD showcases flat red bars.

-

The bears seem to be taking a breather to consolidate losses.

In Tuesday’s session, EUR/GBP retreated mildly to the 0.8570 region. The daily and four-hour charts suggest a cooling of the recent selling momentum, which favors neutrality to a bearish outlook for the short term.

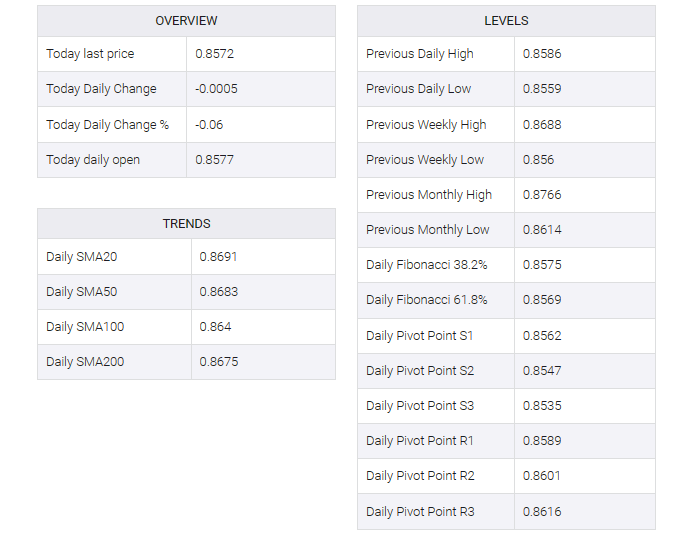

The daily Relative Strength Index (RSI) is deep in negative territory, while the Moving Average Convergence Divergence (MACD) shows flat red bars, reinforcing the bearish hold. Additionally, the asset’s position below the 20, 100, and 200-day simple moving averages (SMAs) underscores ongoing bearish restraints, marking a challenging landscape for buyers.

Shifting to the shorter time frame, the dynamics on the four-hour chart still present the bears in recovery mode. The four-hour Relative Strength Index (RSI) remains in negative territory, while the MACD’s flat red bars favor a bearish consolidation. Hence, the short-term bias leans to the downside, although sellers may be taking a breather after the recent run.

Support Levels: 0.8550, 0.8500, 0.8480.

Resistance Levels: 0.8600, 0.8639 (100-day SMA), 0.8700.