-

EUR/GBP drifts lower for the fifth straight day and drops to a nearly two-week low on Tuesday.

-

The GBP’s relative outperformance comes amid rising bets for additional rate hikes by the BoE.

-

The mixed UK jobs data fails to push back against hawkish BoE expectations or lend any support.

-

Speculations for more jumbo rate hikes by the ECB warrant caution for aggressive bearish traders.

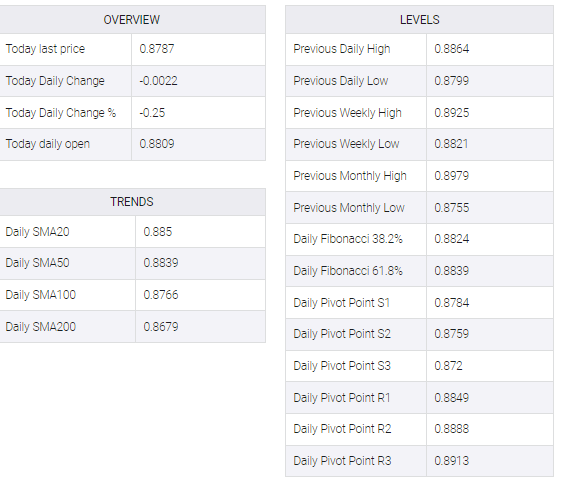

The EUR/GBP cross remains under some selling pressure for the fifth successive day on Tuesday and drops to a nearly two-week low during the early European session. The selling bias remains unabated following the release of the mixed UK monthly employment details and drags spot prices below the 0.8800 mark, with bears now eyeing to challenge a technically significant 100-day Simple Moving Average (SMA).

In fact, the UK Office for National Statistics reported that the number of people claiming unemployment-related benefits fell by 11.2 thousand in February, less than the expected 12.4 fall. The slight disappointment, however, was offset by a sharp downward revision to the previous month’s reading to show a 30.3K drop in claimant count changes against estimates of a 12.9 fall. Furthermore, the unemployment rate was steady at 3.7% compared with 3.8% in the three months to January, while the rolling three-month average indicated that UK wages were cooling. Nevertheless, the data is strong enough to allow the Bank of England (BoE) to raise interest rates later this month, sending the British pound lower and exerting downward pressure on the EUR/GBP cross.

In addition to this, a good pickup in US dollar demand is seen weighing on the shared currency, further contributing to the heavily offered tone surrounding the EUR/GBP cross. That said, recent dovish comments by several European Central Bank (ECB) officials, stressing the need for interest rate hikes beyond March, may lend some support to the euro. Traders may refrain from placing aggressive bearish bets ahead of the ECB monetary policy meeting scheduled for Thursday. The focus will then shift to the BoE meeting next week, which will help determine the next leg of a directional move for the cross. Hence, any further decline is more likely to find modest support near the 100-day SMA, which will serve as a critical point before the central bank’s key event risks.