-

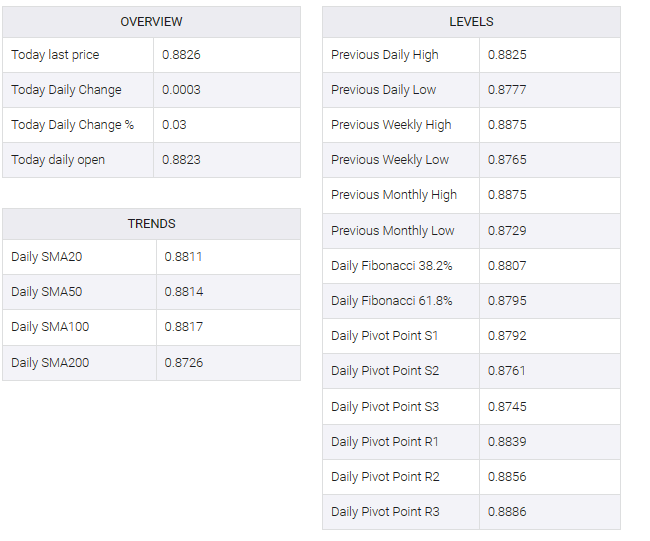

EUR/GBP is approaching 0.8840 after sustainability above 0.8800 ahead of ECB policy.

-

Credit demand in Eurozone has dropped dramatically amid higher interest rates.

-

The BoE is preparing to raise interest rates further by 25 bps next week.

The EUR/GBP pair is aiming to capture the critical resistance of 0.8840 as the cross confidently established above the round-level resistance of 0.8800 in the Asian session. The cross attracted significant bids as stubborn Eurozone inflation is supporting a continuation of bumper interest rate hikes from the European Central Bank (ECB).

On Tuesday, the monthly preliminary Eurozone Harmonized Index of Consumer Prices (HICP) accelerated to a 0.7% pace, which was lower than consensus and a prior release of 0.9%. Surprisingly, the annual HICP jumped to 7% vs. 6.9% as expected. Meanwhile, annual core inflation rose to a slower pace of 5.9% and monthly core HICP to 1.0%.

Eurozone inflation did not show a significant decline on a broad basis led by labor shortages, which is pushing up the employment cost index. This reinforced the continuation of bumper interest rate hikes from the ECB. ECB President Christine Lagarde’s announcement of a 50 basis point (bp) interest rate hike will push rates to 4%.

The Eurozone economy appears poised to show a slowdown ahead as the recently released Bank Lending Survey (BLS), the European Central Bank (ECB) noted that a net 38% of Eurozone banks reported a reduction in loan demand from companies early on. quarter of the year. Also, banks have tightened their lending conditions amid a volatile environment. “In an environment of monetary policy tightening, the general level of interest rates is reported to be the main driver of reduced credit demand,” the ECB said.

Meanwhile, the pound sterling is failing to defend its downside as the UK economy enters a situation of high interest rates and stubborn inflation, which will hit households hard as budgets are out of balance to pay for inflation-adjusted goods and services. The Bank of England (BoE) is expected to raise interest rates by another 25 basis points (bps) next week.