-

EUR/GBP is eyeing further sell-off below 0.8700 as BoE to raise rates further to bring down double-digit inflation.

-

Investors have been gung-ho for the Pound Sterling amid an absence of a confident roadmap for bringing down the UK’s inflation.

-

Global interest rate hikes have heavily impacted German Industrial Production.

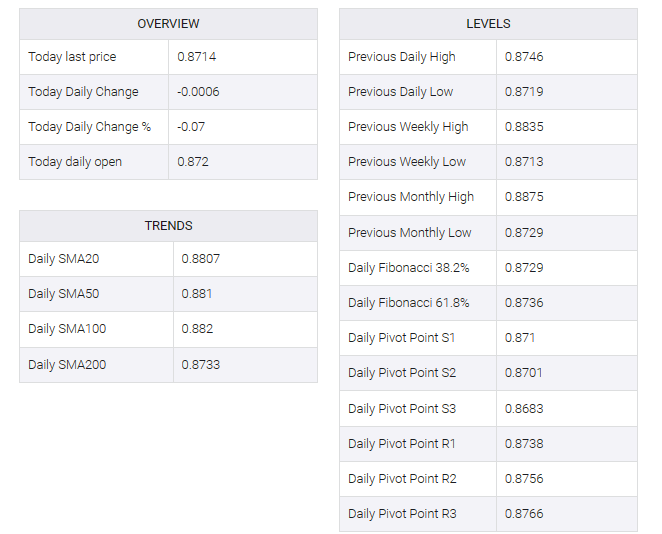

The EUR/GBP pair is looking weak above the round-level support of 0.8700 in the Asian session. The cross is expected to show further weakness as investors expect more interest rate hikes from the Bank of England (BoE) to soften double-digit United Kingdom inflation.

Investors are gung-ho for the pound sterling in the absence of a confident roadmap to bring UK inflation down to the 2% target. Economists at MUFG Bank do not expect the Bank of England meeting to weigh on sterling. The pound remains the top-performing G10 currency in 2023 and is the best performer in Q2 so far.

BoE Governor Andrew Bailey has already pushed interest rates to 4.25% at the last 11 monetary policy meetings and now another rate hike is widely expected. However, it is still difficult to agree that inflationary pressures will cover the large gap between current and desired inflation.

Historically high food inflation, labor shortages due to early retirements, and higher wage offers have been key catalysts, adding to inflationary pressures.

On the Eurozone front, higher interest rates by the European Central Bank (ECB), reduced credit from Europe’s commercial banks and weak industrial production are calling for a recession ahead. On Monday, monthly German industrial production contracted sharply by 3.4%, against expectations of a 1.0% contraction and a 2.1% decline in previous releases. A rise in global interest rates due to weak demand for automobiles has greatly affected German industrial production.

Over the interest rate guidance, ECB chief economist Philip Lane said that there was “a lot of disinflation” coming later this year but added that there was still “a lot of momentum” in inflation.