-

EUR/GBP sees Tuesday gains for a fresh test of 0.8600.

-

UK earnings miss the mark, EU sentiment improves sharply.

-

The pair remains deeply bearish, with the momentum bias leaning bullish.

EUR/GBP returned to the 0.8600 handle on Tuesday, bolstered by a lack of UK average earnings and a better-than-expected print in the Eurozone’s ZEW Economic Sentiment Survey.

Average UK earnings, including and excluding bonuses, missed market estimates on Tuesday, printing less than expected and softening the pound sterling (GBP) against the euro (EUR).

UK average earnings excluding bonuses for the quarter ended October showed earnings rose 7.3% compared to the same period last year, coming in below market forecasts of 7.4% and lagging from 7.8% in the previous period (revised slightly from 7.7%, further widening the gap). .

UK average earnings including bonuses fell similarly, printing at 7.2% against a forecast 7.7% and the opposite direction to the previous period’s 8%, which was similarly revised upwards from 7.9%.

UK claimant count changes in November beat market expectations, but still printed worse than the previous month, showing 16K extra jobless benefit seekers vs 20.3K forecast; There were 8.9K new claimants in October, sharply revised down from 17.8K.

The eurozone’s ZEW Economic Sentiment Survey beat expectations to print a firm 23.0, easily beating forecasts of 12.0 and vaulting above the previous month’s 13.8.

Market focus to shift to BoE, ECB double feature

There will be some breathing room with mid-level industrial production in both the UK and EU ahead of Thursday’s double-header from both the Bank of England (BoE) and European Central Bank (ECB) on Wednesday.

Both central banks are widely expected to hold rates steady, and investors will be closely watching policy statements from both banks and trying to get a handle on how hawkish or dovish the BoE and ECB are moving in new directions this year.

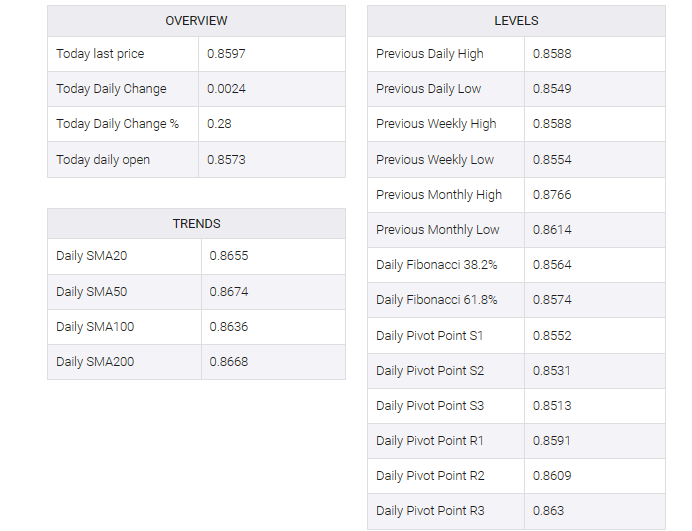

EUR/GBP Technical Outlook

The Pound Sterling’s (GBP) early slump on Tuesday sees the Euro (EUR) catching a bid and sending the EUR/GBP back into the 0.8600 handle. Price action is drawing tight once more and the pair is struggling to maintain a hold on the key level, but intraday bids are catching technical support from the 200-hour Simple Moving Average (SMA) near 0.8580.

Despite Tuesday’s bullish bump, the EUR/GBP remains steeply bearish, weighed down near multi-month lows with price action trading well below the 200-day SMA drifting into the 0.8660 level.

0.8560 is hardening into a firm price floor keeping bearish momentum constrained for the time being, while bullish plays will see a hard barrier near 0.8620.