-

EUR/GBP looks vulnerable around 0.8800 as hawkish BoE bets soar after a recovery in UK preliminary PMI data.

-

Hunt in the UK is facing calls from within his Conservative Party to cut taxes and raise the pay of public service workers.

-

ECB Lagarde is set to continue its policy tightening spell of 50 bps to March.

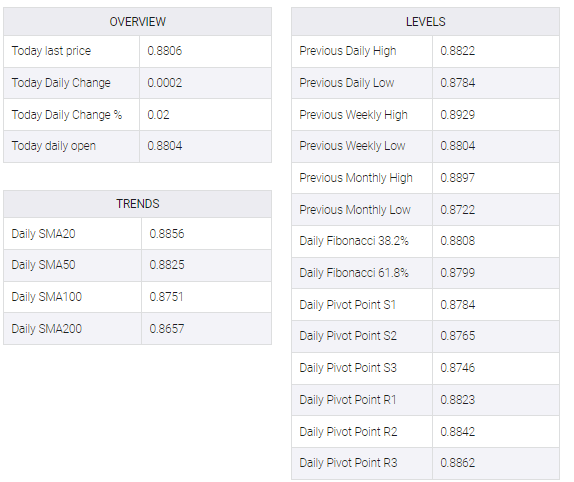

The EUR/GBP pair is struggling to find any direction in the Tokyo session amid the absence of a potential trigger. The cross is juggling around 0.8800 and is expected to display more weakness as an economic recovery in the United Kingdom and a shortage of labor is demanding the continuation of policy tightening by the Bank of England (BoE).

Investors were in a dilemma whether the Bank of England (BoE) should pause policy contraction as the economic outlook was expected extremely bleak or continue pushing rates higher to tame stubborn inflation. Shortage of labor and escalating food inflation is continuously maintaining havoc that the inflation could be underpinned anytime to new highs.

No doubt, the UK Consumer Price Index (CPI) has eased in the past few months, however, the headline CPI figure is still in double-digit and sufficient to trouble households.

Meanwhile, the recovery in economic activity shown by the preliminary S&P Global PMI (February) data released this week indicates that labor demand may pick up further and BoE Governor Andrew Bailey should consider a continuation of policy tightening. A figure below 50.0 for primary manufacturing activity indicates contraction, however, the pace of decline in activity has been significantly subdued.

BoE panel sees the interest rate peak around 4.5% and the continuation of the rate hike in the March monetary policy meeting looks warranted.

Meanwhile, UK Finance Minister (FM) Jeremy Hunt is facing calls from within his Conservative Party to cut taxes in his March 15 budget and from trade unions to raise pay for public service workers, as reported by Reuters, which could propel inflationary pressures further.

On the Eurozone front, clarity on the extent of the rate hike by the European Central Bank (ECB) President Christine Lagarde has eased some uncertainty. ECB Lagarde has announced a continuation of 50 bps rate hike spree for March to keep the downside momentum in Eurozone inflation intact.