-

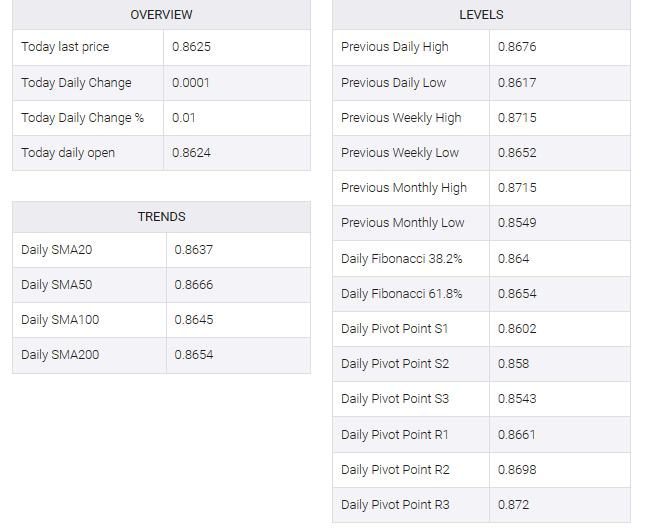

EUR/GBP remains on the defensive near 0.8625, ahead of Eurozone mid-tier data.

-

The German Unemployment Rate remained flat at 5.9%, as expected.

-

Traders anticipate that the Bank of England (BoE) will cut rates as soon as May 2024.

The EUR/GBP cross found some support near the weekly low of 0.8610 and moved closer to 0.8625 during Thursday’s first European session. Eurozone HCOB Composite PMI, Services PMI for December and German Consumer Price Index (CPI) will be released later on Thursday. These figures can trigger volatility in the cross.

The German statistics office revealed on Wednesday that the country’s unemployment changes showed that the number of unemployed people rose by 5K from the previous reading of 21K, better than the 20K estimate. Meanwhile, the German unemployment rate remained flat at 5.9% as expected.

On the British pound front, UK manufacturing PMI came in at 46.2 in December versus 46.4 previously, missing expectations of 46.4, S&P Global showed on Tuesday. Traders raised their bets that the Bank of England (BoE) will be forced to cut rates as soon as May as policymakers shift their focus from high inflation to a stagnant economy. This, in turn, could weigh on the British Pound (GBP) and cap the downside of the EUR/GBP cross.

Market participants will closely monitor the German inflation report for fresh impetus. The German Harmonized Index of Consumer Prices (HICP) for December is estimated to rebound to 3.8% YoY from 2.3% in the previous reading.