-

EUR/GBP loses momentum near 0.8572 following UK employment data.

-

The UK’s ILO Unemployment Rate remained steady at 4.2% in the three months to October.

-

The easing in inflationary pressure in the Eurozone fuels the bet for rate cuts early next year.

-

Investors will focus on the German and Eurozone ZEW Survey, due on Tuesday.

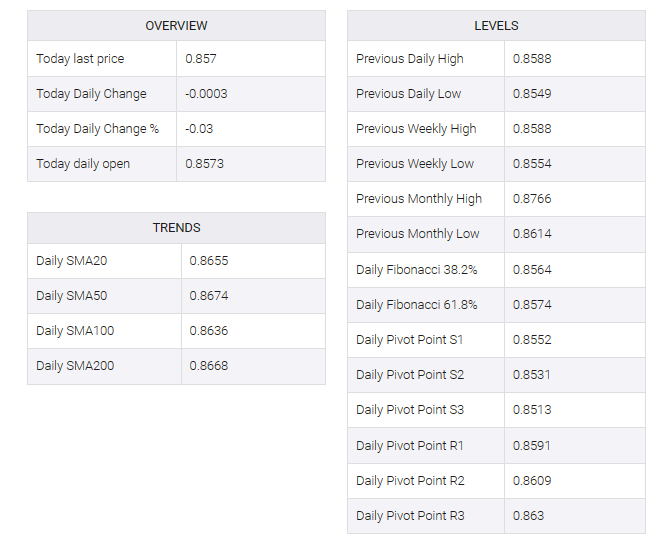

The EUR/GBP cross remained defensive above the mid-0.8500s in the early European session on Tuesday. Cross attracts some buyers following UK employment data. However, EUR/GBP’s upside may be limited as investors don’t trust the European Central Bank (ECB) for long rate details in the Eurozone. At press time, the cross was trading at 0.8572, down 0.03% on the day.

The latest data from the UK Office for National Statistics showed on Tuesday that the country’s ILO unemployment rate was steady at 4.2% in the three months to October, in line with market expectations. Additionally, the number of people claiming jobless benefits rose by 16K in November versus an increase of 8.9K in October, above the market consensus of 20.3K. British employment change data for October rose to 50K from the previous reading of a 54K gain.

Expectations that the Bank of England (BoE) may keep rates on hold and maintain their highs for the longer term, lifted the British Pound (GBP) against the Euro (ECB). Market players expect the BoE to be the last of its peers to ease monetary policy.

On the euro front, traders will focus closely on the ECB monetary policy meeting, which is likely to keep its deposit facility rate unchanged at 4.0%. Eurozone inflation came in at 2.4% in November, the lowest level in more than two years. Easing inflationary pressures in the eurozone bet on a rate cut early next year. The market is now pricing in a higher rate of 130 basis points (bps) starting from March next year.

Looking ahead, German and Eurozone ZEW surveys will be released later on Tuesday On Thursday, BoE and ECB interest rate decisions will be in the spotlight. Traders will take cues from these key events and find trading opportunities around the EUR/GBP cross.