-

EUR/GBP comes under some selling pressure following the release of the UK inflation figures.

-

The stronger UK CPI print reaffirms bets for more BoE rate hikes and boosts the British Pound.

-

Bets for a smaller ECB rate hike contribute to the Euro’s underperformance and exert pressure.

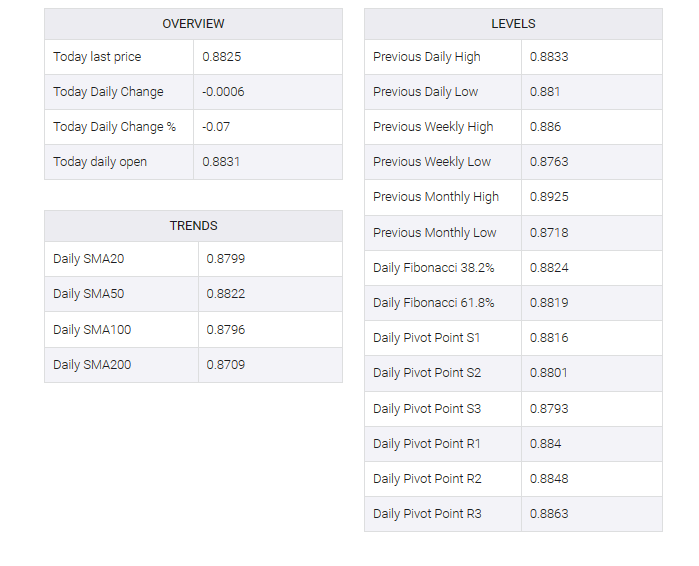

The EUR/GBP cross meets with some supply during the early European session on Wednesday and drops to a fresh weekly low, around the 0.8810 region in reaction to stronger UK consumer inflation figures.

The British pound strengthened slightly after the UK Office for National Statistics (ONS) reported that headline UK CPI came in lower than expected, at 10.1% YoY in March versus 10.4% recorded in the previous month. Moreover, core CPI, which excludes volatile food and energy items, was steady at 6.2% YoY in the reported month, beating expectations of a slide to 6.0%. This comes on the back of Tuesday’s strong UK wages growth data and should keep pressure on the Bank of England (BoE) to raise interest rates further, which in turn should see the EUR/GBP cross drag lower.

The shared currency’s relative underperformance can also be attributed to the fact that European Central Bank (ECB) policymakers have left the door open for a downward spiral in the pace of interest rate hikes. Indeed, ECB member Martins Kazaks said on Monday that the central bank could opt for a 25 bps hike at its next meeting in May. This further contributes to a slightly softer tone surrounding the EUR/GBP cross. That said, the lack of any solid follow-through selling is some caution for aggressive bearish traders and at least for the time being before positioning for another intraday bearish move.

Market participants are now awaiting the release of the final Eurozone CPI print, which could impact the Euro and provide some impetus to the EUR/GBP cross. Apart from this, traders will take cues from the BoE’s quarterly bulletin for the central bank’s outlook on the state of the UK economy. This could further contribute to building short-term business opportunities ahead of BoE MPC member Catherine Mann’s scheduled speech.