-

EUR/GBP picks up bids to consolidate the biggest daily loss in three weeks.

-

Bearish oscillators, sustained trading below one-week-old descending trend line keep sellers hopeful.

-

Bears could aim for 61.8% Fibonacci retracement, 200-DMA on breaking immediate support.

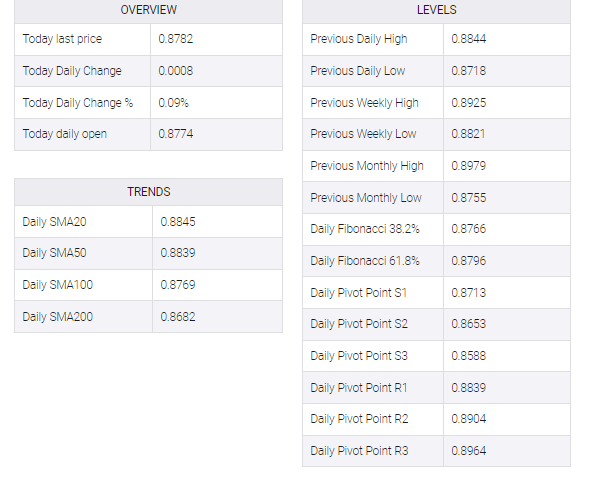

EUR/GBP renews intraday high near 0.8790 as it extends the late Wednesday’s bounce off the lowest levels since December 2022 heading into Thursday’s European session. In doing so, the cross-currency pair rebounds from the 100-DMA while paring the biggest daily loss in three weeks ahead of the key European Central Bank’s (ECB) Monetary Policy Meeting.

Although the key moving average allows buyers to return to the desk, their dominance remains doubtful as the MACD flashes bearish MACD signals. Also challenging the upside bias are the downbeat conditions of the RSI (14) line, not oversold, as well as a one-week-old descending trend line, around 0.8815.

Even if EUR/GBP recovers past the 0.8815 immediate barrier, the 0.8900 threshold and 0.8930 resistance level near 0.8980 could challenge the pair’s further advance before pointing the bulls towards the yearly highs marked in February.

Meanwhile, pullback moves need a daily closing below the 100-DMA support of 0.8770, as well as the 50% Fibonacci retracement level of the pair’s December 2022 to February 2023 upside near 0.8760, to convince sellers.

Following that, the 61.8% Fibonacci retracement, also known as the golden Fibonacci ratio, could challenge the EUR/GBP bears around 0.8710 ahead of highlighting the 200-DMA support of 0.8683.

EUR/GBP: Daily chart

Trend: Limited upside expected