-

-

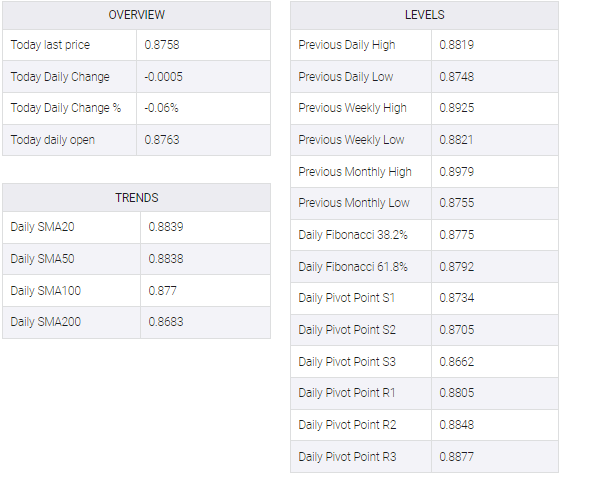

EUR/GBP prints three-day losing streak, justifies downside break of 0.8770-75 confluence.

-

Bearish MACD signals add strength to downside bias.

-

Recovery moves need validation from 0.8815 to convince bulls.

EUR/GBP justifies the negative interruption of the previous original support confusion because it depicts the three-day downtrand around 0.8760 to Friday’s London Open. As a result of doing so, the cross-currency pair is close to the ear-to-date (YTD) at the beginning of the week.

The daily closing under the 0.8775-70 support-turned-registance confluence, the EUR/GBP comprising an upward-loose trend line from the end of December 2022 and the end of December 2022 is optimistic. The power of downward bias is being added to the beerish macd signal and low high formation from March 08.

It says 61.8% of the pair’s upward from December to February, the Fibonachi retraction level, about 0.8710, seems to be tempting the EUR/GBP beer late.

After that, on December 20, the lower 0.8690 of 2022 and around 0.8685 can act as the main negative support for challenging the 200-DMA level EUR/GBP beer, with a break up to the end of 2022 to draw the price toward 0.8550. Can .

Alternatively, recovery moves need to provide successful trading above the 0.8770-75 resistance confluence, previous support, to tease the EUR/GBP buyers.

Even so, a one-week-old descending resistance line, around 0.8815, precedes a three-week-old horizontal resistance, near 0.8835, to challenge the EUR/GBP buyers.

To sum up, EUR/GBP is likely to extend the latest south-run towards refreshing the YTD lows.

EUR/GBP: Daily chart

Trend: Further downside expected

-