-

EUR/GBP has built a cushion around 0.8900 amid rising odds of a tight BoE policy.

-

A breakout of the Descending Triangle has already underpinned the Euro against the Pound Sterling.

-

Upside momentum is still active as the RSI (14) has not surrendered the bullish range yet.

The EUR/GBP pair has gauged an intermediate cushion around 0.8900 in the Asian session. The cross has been consolidating in a 20-pip range from the past two trading sessions. The upside bias for the pair looks favored as expectations for a steady Bank of England (BoE) monetary policy are solidifying.

A forecast by the British Chambers of Commerce (BCC) that “the country’s economy is on course to shrink less than expected this year and avoid two quarters of negative growth that marks a technical recession,” Reuters reports, prompting the BoE to tighten policy. May consider stopping.

Also, BoE policymaker Swati Dhingra warned on Wednesday that “excessiveness poses more material risks at this point.” A break in the BoE’s policy constraints could have a negative impact on the pound sterling.

Meanwhile, the European Central Bank (ECB) remains on track with its monetary policy agreement as expectations of a rebound in eurozone inflation improve.

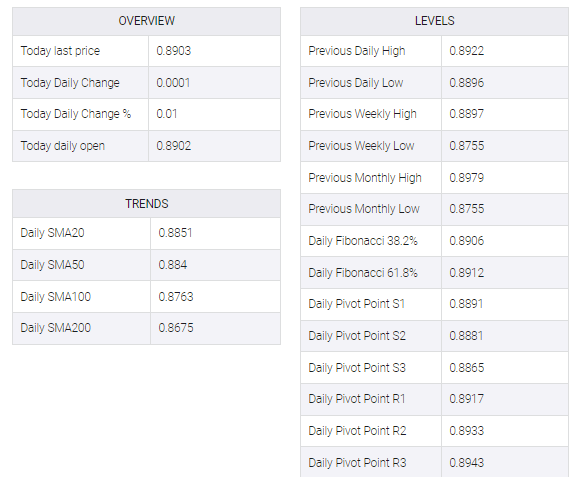

On the four-hour scale, the cross has provided a breakout of the descending triangle chart pattern, indicating an extension of volatility after the simultaneous bearish pressure. The downward-sloping trend of the chart pattern is plotted at the high of 0.8979 from February 03 and the horizontal support is held at the low of 0.8766 from January 30.

The 20-period Exponential Moving Average (EMA) at 0.8893 is providing a cushion to the Euro bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has not surrendered the bullish range of 60.00-80.00 yet, which indicates that the upside momentum is still active.

Should the cross breaks above February 17 high at 0.8929, Euro bulls will drive the asset towards February 3 high at 0.8979 followed by the psychological support at 0.9000.

On the flip side, a breakdown below February 14 low at 0.8804 will expose the asset to January 29 low at 0.8763 and January 19 low at 0.8722.