-

EUR/GBP has printed a fresh day’s high at 0.8836 amid hawkish ECB bets.

-

Eurozone’s inflation is extremely persistent amid labor shortage so favors a big rate hike ahead.

-

March’s UK inflation data holds significant importance as it will be the last before BoE’s May policy meeting.

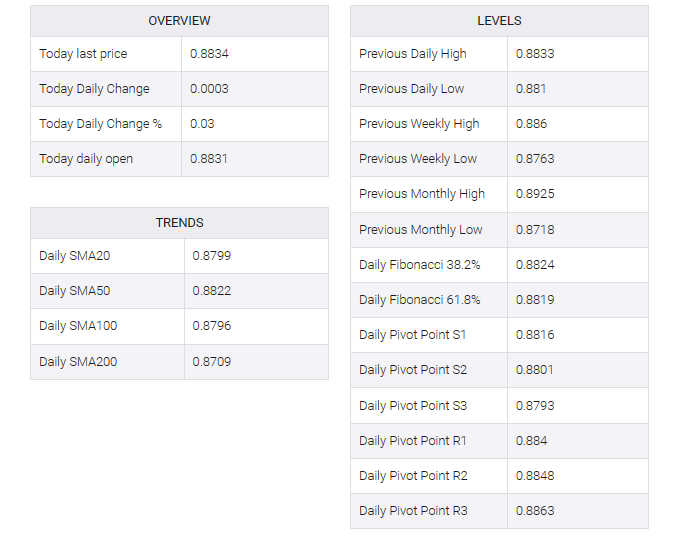

The EUR/GBP pair has printed a fresh day high after climbing above the critical resistance of 0.8830 in the Tokyo session. The cross is eyeing more upside as the street is anticipating a continuation of the rate hike spell by the European Central Bank (ECB).

Eurozone inflation is highly persistent amid labor shortages, leading to higher employment bills from firms. In addition, supply chain disruptions following the Russia-Ukraine war have not cleared, adding to long-term inflationary pressures.

European Central Bank (ECB) President Christine Lagarde is expected to face the challenge of deciding the pace of rate hikes as fears of a recession continue if larger rate hikes continue. Bloomberg reported that after a survey of economists, the majority expect the European Central Bank (ECB) to raise rates by 25 basis points (bps) at its May, June, and July policy meetings. “This will take the deposit rate to 3.75%, where it will remain for the rest of the year.”

On the pound sterling front, higher average earnings data cemented the need for further rate hikes from the Bank of England (BoE). The three-month labor cost index (excluding bonuses) came in at 6.6%, higher than the consensus of 6.2% but in line with the prior release. Higher incomes are expected to increase inflationary pressures, prompting BoE Governor Andrew Bailey to raise rates further.

Further, UK’s Consumer Price Index (CPI) data will be keenly watched. As per the consensus, monthly UK inflation has accelerated by 0.5% against a 1.1% elevation recorded in February. Annual CPI is expected to soften to 9.85 from the former release of 10.4%. Core CPI that excludes oil and food prices is expected to decelerate to 6.0% from the former release of 6.2%. March’s inflation data holds significant importance as it will be the last before May’s monetary policy meeting.