-

EUR/GBP trades listlessly on ECB’s blurred rate hike path amid global banking turmoil.

-

Liquidity crisis and policy uncertainty left Euro with mixed reactions.

-

Market awaits UK CPI and BoE Interest Rate decision next week.

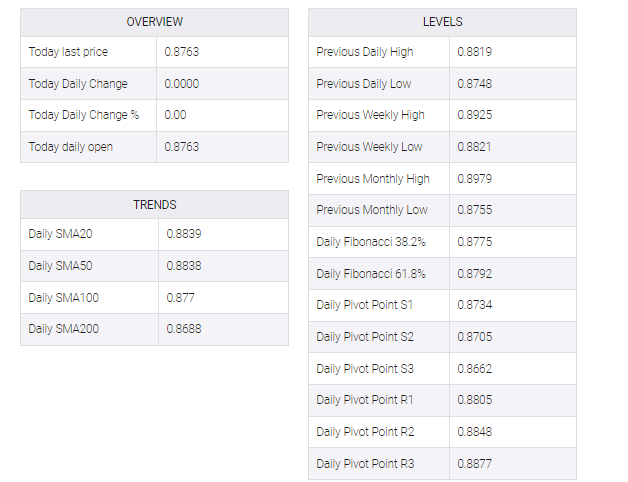

EUR/GBP is currently wandering around the 0.8760 sign, as the European Central Bank (ECB) depicts a vague picture around the way to increase the future rate. Market participants were assumed that the ECB 50 BASIS Point (BPS) would not increase after the recent instability in the global banking sector.

After the fall of the US Silicon Valley Bank (SVB), the market has seen many small banks from small to large banks all over the world fall into the liquidity trap. The Swiss National Bank (SNB) interfered with some rescue plans, but this week the credit swiss was the first European bank to face the liquidity crisis.

Therefore, the expectation was low for the increase in 50 BPS before the ECB rate decision on Thursday. Nevertheless, the ECB has increased the 50 BPs rate. Later, some backdoor sources suggest that the driving force behind the 50 BPS rate was after throwing a lifeline near SNB credit Swiss. By adding it, the ECB feared that increasing 50 BASIS Point would terrorize investors. Although some policy makers did not discuss any changes in rate growth, there was no discussion on the increase in 25 BPS.

Citing the policy statement from the ECB, President Christine Lagard said the underlined price pressure is strong and the wages pressure is strengthened. ECB’s lagarde switched in a data-dependent mode and poured cold water on the expectation of increasing the pre-determined rate. The Euro has received mixed steps across the board of liquidity crisis and policy uncertainty from the ECB.

Therefore, it has dropped the market expectations in the sideline to increase the future rate, waiting to release more information to frame a expectation for the ECB meeting. Later, the 25 BPS growth market for the May meeting is 50-50. For Pound Sterling, it is important to see the Consumer Price Index (CPI) data published from the UK next Wednesday, before the BoE interest rate on Thursday.