-

EUR/GBP drifts lower to 0.8630 ahead of the Eurozone HICP report.

-

ECB’s Vasle said the ECB would need at least until spring to evaluate its policy stance.

-

Investors anticipate the BoE to cut rates five times next year due to the recent drop in annual inflation and annual earnings growth.

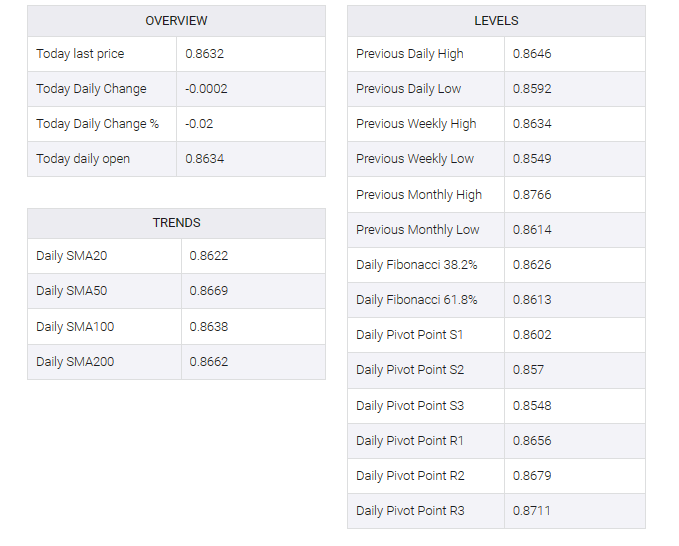

The EUR/GBP cross traded on a softer note during the early European session on Tuesday. The cross is bounding below the key 100-day exponential moving average (EMA) near 0.8645 on the daily chart. Investors await the Eurozone Harmonized Index of Consumer Prices (HICP) report for fresh stimulus. Headline HICP is expected to decline by 0.5% MoM in November, while core HICP is projected to decline by 0.6% MoM over the same period. At press time, EUR/GBP is trading near 0.8631, down 0.03% on the day.

European Central Bank (ECB) policymaker Bostjan Vasle said on Monday that the ECB would need at least until the spring to assess its policy stance and that market expectations for an interest rate cut in March or April were premature. Meanwhile, ECB Governing Council member Peter Kazmir noted that the risks of premature easing are more significant than the risks of prolonged tightening. Nevertheless, markets now expect a rate cut in March, with one expected to be completed by April and more than two paces expected by June.

On the other hand, investors expect the Bank of England (BoE) to cut interest rates five times next year, which has led to annual inflation falling to 4.6% and estimates of annual income growth falling to 7.2% from 8%. . However, BoE policymaker Ben Broadbent said that in the current uncertain environment, the labor market was cooling and the central bank needed to see more and an ongoing slowdown in wage growth before declaring a fight against wage inflation won.

Later on Tuesday, traders will monitor Eurozone HICP inflation data. If the report shows weaker-than-expected figures, it could put some selling pressure on the Euro (EUR) and push the EUR/GBP cross higher. On Wednesday, UK Consumer Price Index (CPI), UK Producer Price Index (PPI), and Eurozone PPI data will be released.