-

EUR/GBP rallied with some supply and moved away from Thursday’s near two-week high set.

-

Bets for more interest rate hikes by the BoE and the ECB warrant caution for aggressive traders.

-

A sustained weakness below the 100-day SMA is needed to support prospects for deeper losses.

The EUR/GBP cross comes under some selling pressure on Friday and extends the previous day’s pullback from the vicinity of the 0.8900 mark, or a nearly two-week high. The intraday downtick picks up pace during the first half of the European session and drags spot prices to a fresh daily low, around the 0.8845 region in the last hour.

The British Pound draws support from rising bets for additional rate hikes by the Bank of England (BoE) and turns out to be a key factor dragging the EUR/GBP cross lower. It is worth recalling that the BoE Governor Andrew Bailey said on Wednesday that some further increase in bank rates may turn out to be appropriate, though added that nothing is decided. This was followed by hawkish remarks by the BoE Chief Economist Huw Pill on Thursday, noting that Britain’s economy is showing slightly more momentum than expected and pay growth is proving a bit faster than the central bank forecast last month.

The downside of the EUR/GBP cross, however, appears to have lifted amid expectations that the European Central Bank (ECB) will continue to raise rates in the coming months. Indeed, the minutes of the February ECB meeting reflect a very unpleasant debate and a clear determination to raise rates beyond March. Adding to this, Bostjan Vasle, a member of the ECB Governing Council, said on Friday that he expects additional hikes to follow the March rate hike. Separately, ECB policymaker Madis Mueller noted that rates should remain high for some time, supporting the possibility of a 50 bps rate hike in March.

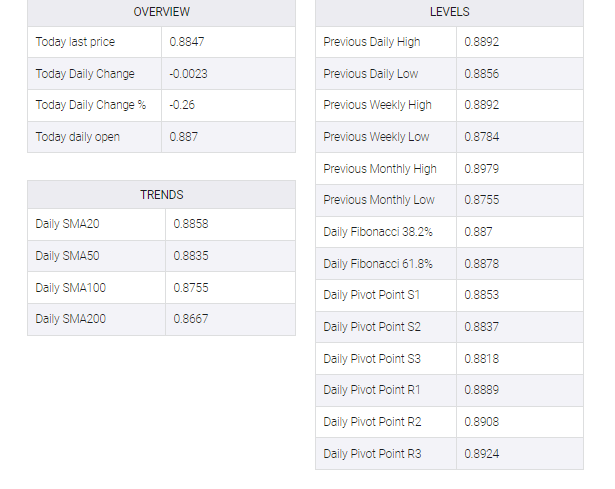

On the economic data front, the composite Eurozone Services PMI for February was revised lower to 52.7 from the 53.0 anticipated. In contrast, the UK Services PMI was finalized at 53.5 against the flash estimate for a reading of 53.3. This further contributes to the offered tone surrounding the EUR/GBP cross. That said, the aforementioned mixed fundamental backdrop warrants some caution before placing aggressive bearish bets and confirming that this week’s bounce from the 100-day Simple Moving Average (SMA) has run out of steam.