-

The Euro bounces up to retest 0.8700 buoyed by ECB´s Holzmann’s comments.

-

Holzmann affirms that there is no guarantee for rate cuts in 2024.

-

The absence of Eurozone data increases the impact of ECB rhetoric.

The euro maintained its bullish tone against the British pound on Thursday, with the pair bouncing back strongly to 0.8670 to test a one-month high of 0.8700.

The pair has been backed by ECB members and the governor of the Austrian National Bank, who played down speculation about a rate cut in 2024, providing a fresh boost to the euro.

Apart from that, positive risk sentiment seems to favor the euro rather than the pound. The common currency is surfing the Santa Claus rally, citing the absence of key eurozone data to defy dovish comments from ECB policymakers.

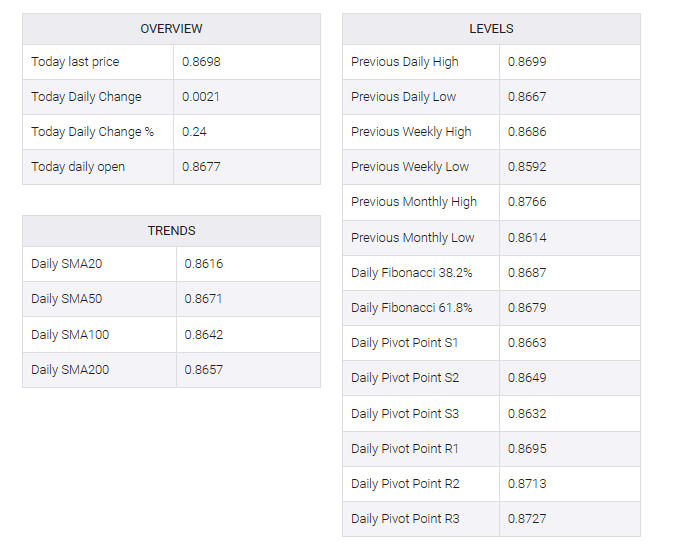

From a technical perspective, Tuesday’s bullish engulfing candle confirmed the positive trend, giving additional hope for buyers, although 0.8700 appears to be a challenging level, as shown on Wednesday’s reversal.

A clear break of the 0.8700 level would increase bullish pressure towards the November 22 and 23 highs, at 0.8725 and November’s peak, at 0.8765.

On the downside, support levels are 0.8645 and 0.8600.