-

EUR/USD holds below 1.0800 on a modest US Dollar strength.

-

US Consumer Price Index (CPI) report broadly matched market expectations.

-

German ZEW Indicator of Economic Sentiment came in at 12.8 vs. 9.8 prior, above the market consensus of 8.8.

-

The Fed interest rate decision and press conference will be closely monitored by traders.

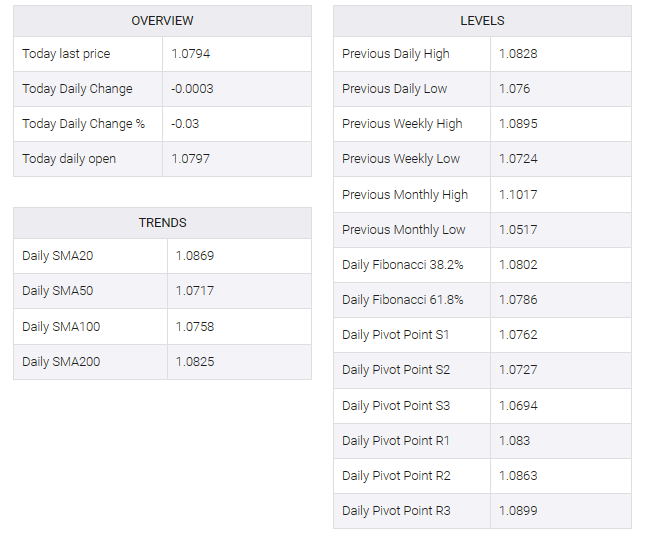

The EUR/USD pair remained limited below the 1.0800 mark during early Asian trading hours on Wednesday. The Federal Reserve (Fed) and European Central Bank (ECB) will announce their decisions on monetary policy on Wednesday and Thursday respectively. At press time, the major pair is trading at 1.0792, having lost 0.04% on the day.

The US inflation report broadly matched market expectations, with the headline Consumer Price Index (CPI) rising 0.1% MoM in November from 0% in October while the annual headline CPI fell to 3.1% from 3.2% in November. Additionally, core CPI rose to 0.3% MoM from 0.1% in the previous month. On an annualized basis, the core CPI figure rose 4.0% YoY as expected.

The ECB is expected to keep interest rates unchanged at its December meeting on Thursday, although eurozone inflation is falling much closer to its 2.0% target. The ECB prepared to push back on market expectations for an early March rate cut, saying it still sees downside risks to prices, particularly from rising wages. Last month, ECB President Christine Lagarde said she still wanted to see clear evidence that a tight labor market was not causing another inflation spike.

On Tuesday, the German ZEW Indicator of Economic Sentiment came in at 12.8 vs. 9.8 earlier, above the market consensus of 8.8 while the current conditions index fell to -77.1 from a previous reading of -79.8, below expectations of -75.5. Furthermore, the Eurozone ZEW Economic Sentiment Index beat estimates of 12.0, rising to 23.0 from the previous reading of 13.8.

Markets expect the Fed to keep overnight lending rates between 5.25% and 5.5% at Wednesday’s December meeting. Additionally, the market is pricing in an aggressive rate cut, with an 80% chance of a rate cut in May and at least a full percentage point cut by the end of the year, according to the CME FedWatch tool.

Moving forward, the US producer price index (PPI) will be released on Wednesday ahead of the Fed’s interest rate decision. After the monetary policy meeting, Fed officials will update their forecasts on economic growth, inflation and the labor market. Traders will take cues from this event and find trading opportunities around the EUR/USD pair.