EUR/USD trades with mild losses near 1.1037 amid light trading.

The Federal Reserve’s favored inflation gauge, the Core PCE, grew 3.2% YoY, below the 3.3% expected.

ECB’s Lagarde clarified that the ECB’s policy decisions are data-dependent and not influenced by market pricing or time-bound pressures.

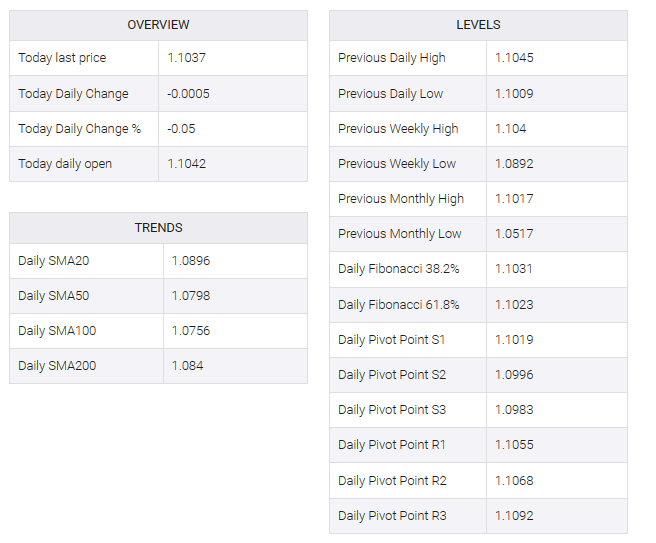

The EUR/USD pair trades near the highest level since August around 1.1040 during the early Asian trading hours on Wednesday. No top-tier economic data will be released this week, and the US Dollar (USD) is likely to remain under pressure due to the lack of any major data that might slow the downward momentum. EUR/USD currently trades around 1.1037, losing 0.04% on the day,

The Federal Reserve’s preferred inflation gauge, the core Personal Consumption Expenditures Price Index (PCE), which excludes energy and food prices, rose 3.2% YoY, missing forecasts of 3.3%. On a monthly basis, core PCE rose 0.1%, below the consensus of 0.2%. The Federal Open Market Committee (FOMC) decided to keep interest rates steady at its most recent December meeting and signaled three rate cuts in 2024.

On the euro front, the European Central Bank (ECB) kept its benchmark interest rate unchanged at its year-end meeting. ECB President Christine Lagarde clarified that the ECB’s policy decisions are data-driven and not influenced by market prices or time-frame pressures.

ECB Vice President Luis de Guindos said it was premature to start easing monetary policy while the central bank did not foresee a technical slowdown in the eurozone. That being said, further dovishness from the ECB could lift the Euro (EUR) and limit the downside for the EUR/USD pair.

The US Richmond Fed manufacturing index for December will be out on Wednesday, and initial jobless claims will be released on Thursday. In the absence of top-level US economic data from the Eurozone and the US, risk sentiment will likely remain the key driver behind EUR/USD price action.