-

EUR/USD pares gains amid upbeat US Dollar.

-

German Unemployment Change reduced to 5K from 22K prior.

-

The seasonally adjusted Unemployment Rate remained consistent at 5.9%.

-

The improved US Treasury yields are reinforcing the strength of the Greenback.

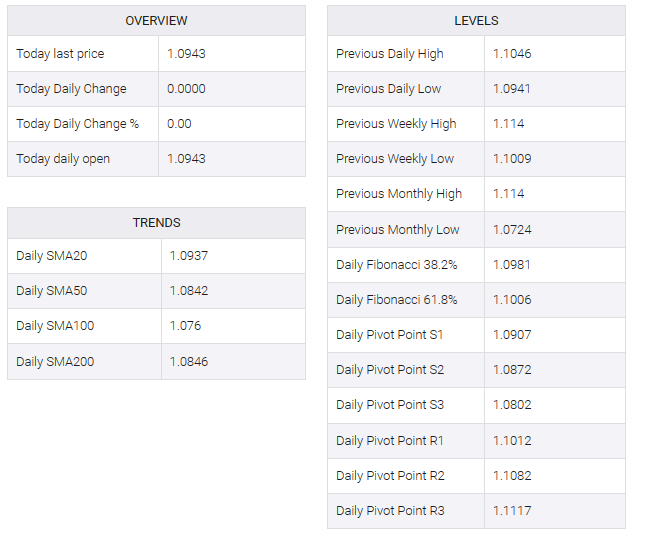

EUR/USD is struggling to recover its recent losses registered in the previous session, trading around 1.0940 during the European session on Wednesday. December’s moderate German unemployment data appears to have weighed on the euro (EUR). The change in unemployment showed that the number of unemployed people fell to 5K from 20K and 22K earlier against the market consensus. However, the seasonally adjusted unemployment rate was in line with expectations at 5.9%.

The EUR/USD pair has been challenged by risk-off market sentiment. Market participants are eyeing the possibility of a policy rate cut from the European Central Bank (ECB) to boost the economy. Moreover, ECB policymaker Pablo Hernández de Cos stressed on Tuesday that economic data uncertainty remains high and that the ECB’s decision to start cutting interest rates will be data-driven. However, investors look set for six rate cuts from the ECB to 2024.

Market participants are reassessing the possibility of an interest rate cut by the US Federal Reserve (Fed) in the first quarter of 2024, driven by expectations of strong growth in the United States (US) economy later in the year. This revaluation has contributed to the greenback’s strength, with the bullish US Dollar Index (DXY) maintaining its winning streak near 102.30 at press time.

The continued gains of the US Dollar are supported by enhanced US Treasury yields. At the time of writing, the 2-year and 10-year yields on US Treasury bonds stand higher at 4.36% and 3.98%, respectively. Investors are anticipated to closely monitor US data on Wednesday, including the December ISM Manufacturing PMI, November JOLTS Job Openings, and the Federal Open Market Committee (FOMC) Minutes.

(This story was corrected on January 3 at 10:30 GMT to say, in the first bullet point, that EUR/USD pares gains amid an upbeat US Dollar instead of gaining ground.)