-

EUR/USD experiences downward pressure ahead of US data.

-

ECB is expected to maintain its current interest rates; weighing on the Euro.

-

Fed’s assertion on monetary policy is contributing to the strength in US Bond yields.

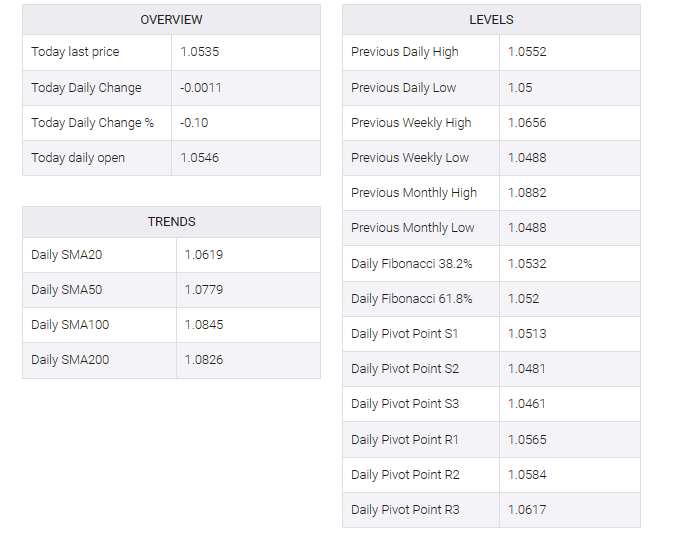

EUR/USD moves lower after two-day gains, trading slightly lower around 1.0540 during the Asian session on Friday. However, the pair found support on the upside, a trend that could be linked to the correction in the US Dollar (USD) following a decrease in US Bond yields.

Germany’s trade surplus for August decreased to €16.6 billion from €17.7 billion in July, surpassing the market’s anticipated figure of €15.0 billion.

The European Central Bank (ECB) is expected to keep its current interest rate at 4.50% at its upcoming meeting later this month. Insights from ECB Governing Council member Mario Centeno on Wednesday suggested that inflation in the euro zone is falling faster than its previous climb. This observation indicates the possibility that the rate cycle has reached its conclusion in the current scenario.

The US Dollar Index (DXY) rebounded and traded near 106.50 so far. The greenback’s correction comes after hitting an 11-month high earlier this week.

US Treasury yields held steady, holding their positions near multi-year highs. Market participants are cautious due to the US Federal Reserve’s (Fed) taunts on the path of interest rates. The 10-year US Treasury yield remained above 4.70%, near the highest level since 2007.

US initial jobless claims for the week ended September 29 rose to 207K from the previous reading of 205K. Surprisingly, it surpassed market expectations of 210K.

US Challenger job cuts significantly decreased to 47.457K from 75.151K in September. Market participants watch Friday for the upcoming release of US nonfarm payrolls and average hourly earnings. These figures will serve as confirmation of the tight labor market, and optimistic numbers could potentially boost USD growth and volatility in bond markets.