-

US dollar holds onto important daily gains after NFP.

-

The employment report boosts the US dollar and yields.

-

EUR/USD heads for a modest weekly loss.

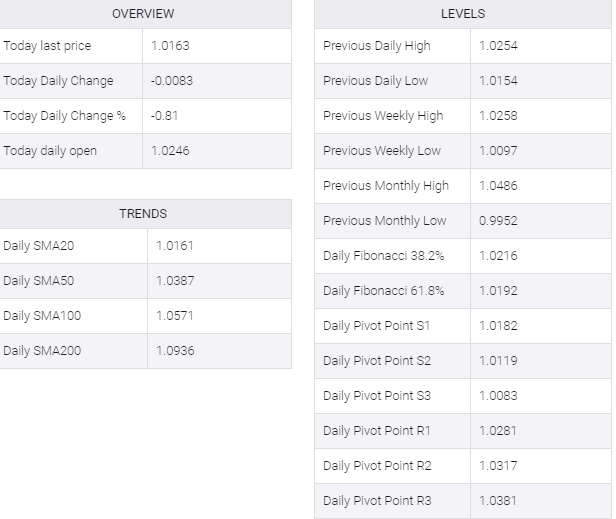

The EUR/USD bottomed on Friday at 1.0140 and then rebounded. The recovery of the euro was not strong enough to regain 1.0200. Near the end of the week, the pair looks vulnerable, on the back of a stronger US dollar.

The July employment report showed that the US economy added 528K jobs, much more than expected. US yields rose after reports boosted the greenback across the board.

After NFP, next week’s key report will be US inflation numbers. July CPI is due Wednesday and a monthly increase of 0.2% is expected. PPI will be released on Thursday. The numbers will be important for Fed rate expectations. Aggressive tightening of the employment report leaves the door open.

Another week in the range

Despite the FOMC and the NFP, the EUR/USD continues to move sideways, as has been the case since mid-July. The euro continues to be rejected from near the 1.0280 zone while at the same time it keeps finding support around 1.0100.

“The weekly chart shows that the long-term bearish stance remains intact. Technical indicators hold within negative levels, the Momentum advancing but the RSI extending its consolidation at around 31. At the same time, the 20 SMA heads south almost vertically, roughly 350 pips above the current level but over 800 pips below the longer ones, a sign of bears’ dominance”, explains Valeria Bednarik, Chief Analysts at FXStreet.

According to Bednarik, a break below 1.0105 will open the door for a retest of parity. On the upside, she argues “EUR/USD would need to accelerate through 1.0280 to shrug off the negative stance and extend its recovery towards 1.0360 first and en route to 1.0440 then.”